The Trade Gap

The United States ran a record trade gap of $716.730 billion in 2005, up from $611.296 billion in 2004. As Americans consumed far more than they produced the nation was forced to sell off assets and run up debt at an unsustainable rate. Gross External Debt to foreigners now equals roughly $10 trillion and has been growing at a rate well over $1 trillion per year. As interest payments on this debt grow, Americans bear the burden in the form of declining living standards. This blog seeks to provide readers with a better understanding of the trade gap and rebalancing process while advocating for sound economic policies that benefit the American public.

Unraveling

Unsustainable and unbalanced systems often collapse under their own weight. This process may have already begun with regards to the US current account deficit as it appears to have reached its peak in October of 2005, with a monthly total of $66.598 billion. The ability of many Americans to consume is being reduced by excessive debt burdens and the willingness of foreigners to invest in unstable American assets may be in decline. This blog will frequently examine the status of American consumers and the nature of foreign investment in the United States in an effort to understand the process of global economic rebalancing.

Rebalancing

As the trade gap grew, the global economy become dangerously unbalanced with many nations depending upon a steady flow of exports to the US. Meanwhile the US economy and far too many US workers are depending on a steady inflow of inexpensive consumer goods and foreign investment capital. It is in the short term economic interest of most countries to see a gradual, controlled rebalancing of the global economy that allows companies and workers to adjust gradually. However, given the size of current imbalances and the fickle nature of financial markets, there is the potential for a dramatic upheaval in both export driven and import driven economies.

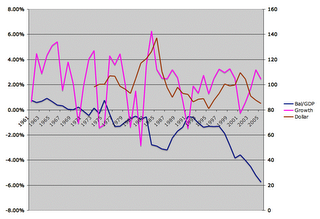

The following chart demonstrates the remarkable growth of the US trade gap over the past 45 years, plotting:

A. The trade gap as a percentage of nominal GDP

B. The annual percentage of real per capita economic growth

C. The value of the dollar against other major currencies

Cause and Effect

Three things jump out at me from looking at the chart above, and all will be discussed in greater detail in future blog entries. For now I'd like to emphasize that:

1. The current trade gap is proportionally far greater than it has been at any point in American history, with the risk of economic upheaval also being high.

2. The competitive advantage the US enjoyed after World War II has been declining steadily, making the task of rebalancing much more difficult as time goes on and external debt piles up.

3. The value of the dollar plays a very large role in the growth of the trade gap, and rebalancing will require a substantial decline in the value of the dollar relative to other currencies.

4. Recessions have followed surges in the trade gap and have temporarily reduced the size of the trade gap as consumers have been forced to cut back on imports.

If the global economy is left to run its own course, then the likely result will be an economic unraveling rather than a controlled rebalancing. Given the size of current imbalances we have good reason to fear a global recession with the greatest impact undoubtedly felt in the United States. By understanding the nature of the rebalancing process we can hope to better protect ourselves and those around us from the potentially damaging effects.

<< Home