State of the Consumer

Simply stated, the trade gap exists because the United States has been importing and consuming more than it has been exporting. A large part of that has been due to consumers taking on greater debt loads to increase their consumption. Foreign investors and domestic lenders have been willing to finance this by extending an large amounts of credit to consumers and homeowners. However, a recent slowdown in the expansion of consumer and mortgage credit could signal an end to the expansion of the trade gap. Whether a decline in consumer spending comes from tightening credit or from the loss of purchasing power, the shift could signal an important change in economic conditions.

Debt Service and Financial Obligagions Ratios published by the Fed show that consumers are getting squeezed tighter each quarter as a greater percentage of in come goes toward paying off debt. Both the Debt Service Ratio and the Financial Obligations Ratio set new record highs in Q1 2006. For many borrowers the idea of taking on more debt has become undesirable. For others, taking on additional debt may be the only way to temporarily avoid bankruptcy. Either way, many consumers are reaching an important transition point.

The period from 1998 to 2001 saw an especially large rise in

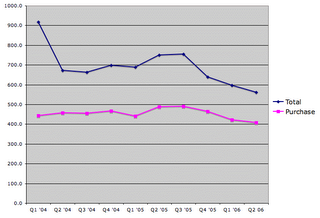

Consumer Credit, while 2001 to 2005 saw a dramatic increase in Real Estate lending. Both sources of credit expansion helped fuel the trade gap, but both appear to be drying up now. Consumer credit is only up 2.2% from May 2005 to May 2006, not nearly enough to keep up with inflation and population growth. Meanwhile, data from the Mortgage Brokers Association shows applications activity is down substantially from last year's peak levels (quarterly averages charted below):

Money Supply data shows a similar decline in the willingness or ability of consumers to spend.

M1, the money people supposedly intend to spend, is only up 1.7% from May to May (+$23.2 billion). All of that gain is the result of an increase in currency floating around (+$34.8 billion) while demand and other checkable deposits are down substantially over the last 12 months.

M2, the small sums of money people supposedly are saving, is up 4.7% for the last 12 months. Within that savings accounts are only up 2.4%, again not enough to keep up with inflation and population growth. Meanwhile, Retail Money funds are up 4.3%, Institutional Money Funds are up 11.9%, Small Time Deposits are up 18.7%, and Large Time Deposits are up 21.0% YoY.

The pattern seems to be that average consumers are getting squeezed while wealthy individuals and institutions are rolling in new cash. This squeeze is likely putting a damper on the trade gap, holding it to the low $60 billions per month. Continued financial stress caused by resetting adjustable rate mortgages and other debt related burdens may reduce the size of the trade gap, but not in a way that is beneficial to most Americans.

Enough rope (credit) is still being provided to almost any consumers who seek to hang themselves. It would have been much better to just keep credit tighter to begin with to avoid creating such extreme imbalances. I believe the least painful way out of this current problem is still to tighten up on lending standards while keeping interest rates low. Of course the financial sector wouldn't think highly of that solution.

<< Home