The monthly trade gap data came out today, and showed some hopeful signs. The revisions continued to be downward and the May number was below analyst estimates. Both are often indications of a trend reversal. Also, exports grew at a good rate, which is the best route toward rebalancing.

On the alarming side, the Balance of Payments continued to expand over the headline trade gap number, coming in over $70 Billion for the month. The total accumulated debt burden is becoming an substantial problem on top of the Goods and Services gap. The May Balance of Payments number was $70.084 billion, or $6.249 billion more than Goods and Services, compared to $5.444 billion more in May of 2005. The debts we are piling up now will be a permanent burden on the American standard of living.

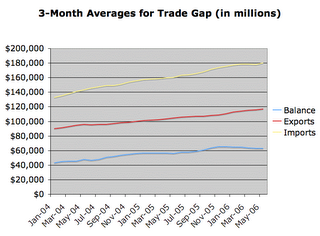

The following chart shows the Goods & Services trade gap starting to trend down (hopefully), with imports showing signs of stalling:

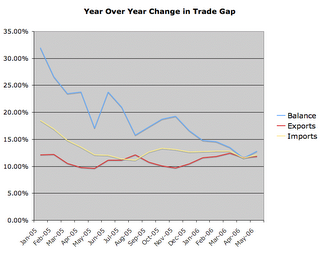

The next chart shows the year-over-year percentage change in trade gap data:

International trade has been a huge growth engine for the economy, both in terms of imports and exports. Unfortunately, much of our imports have been purely consumption based and haven't done much to improve the long-term strength of our economy. Meanwhile, much of our exports have been in the form of capital equipment and construction materials, strengthening our competitors and making the job of rebalancing all the more difficult.

2005 Exports

Capital Goods: $362.686 billion

Consumer Goods: $115.715 billion

Automotive: $98.578 billion

2005 Imports

Capital Goods: $379.227 billion

Consumer Goods: $407.168 billion

Automotive: $239.512 billion

Increasing the size of our exports of consumer goods will be an indication that the rebalancing process is preceding in a positive manner. Unfortunately, consumer goods are the area of exports that is growing most slowly and auto exports actually appear to be contracting. Meanwhile, imports of consumer goods and autos have been on the decline this year, suggesting that the trade gap is unraveling as a result of overburdened consumers, rather than as a result of a strengthening global economy.

<< Home