A National Housing Slowdown

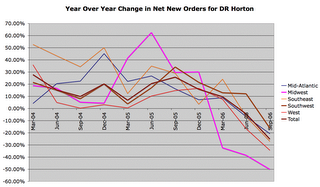

DR Horton calls itself America's builders and wanted to be the "Walmart" of homebuilders by growing rapidly and entering many smaller markets that other national builders weren't interested in. They are much more national in scope than other builders and charting their net new orders gives a general idea of the slowdown nationally:

The slide accelerated in all regions last quarter, in spite of heavy use of incentives. The Southwest finally went negative, and probably still has the farthest to fall from here. The economy has gone bad in the midwest and has taken housing with it.

Small Ohio and Kentucky builder Domininion Homes reported sales that were off 50% year over year last night. WCI Communities (which builds mostly in Florida) reported year over year declines of 80% last week.

Summing up the regions, we have:

Florida as the worst, the Midwest second worst, and California the third worst.

Speculation was the biggest problem in Florida, and it has caused a violent snapback. Credit expansion put too much money in the hands of speculators.

A bad economy is the biggest problem in the Midwest and I expext the rebalancing process to cause a slowdown in the national economy over time.

Affordability issues and rising interest rates pushed the California market over the edge. Too much easy credit was created through global imbalances and it fueled the sub-prime, no-doc, high LTV explosion.

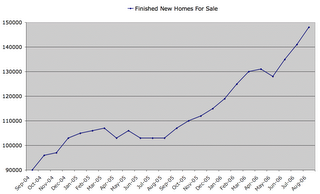

Builders got carried away in the euphoria of the housing bubble and ramped up their expansion plans just as the market was reaching the breaking point. Now they are getting stuck with too much land and unsold inventory and the resulting debt burden is putting a large strain on their financial situation. Finished homes for sale are still on the rise:

Large incentive packages haven't been enough to keep sales up. Kara Homes may be the first large, privately-held homebuilder to declare bankruptcy in this down cycle, but they won't be the last. Dominion Homes will probably be the first of the publicly traded builders to do so, and many more will probably follow.

<< Home