New Monthly Record Trade Gap

The trade gap in July set a new record at $68.044 billion.

The prior record had been $66.598 billion, set in October of 2005.

The big culprits were:

Net imports of petroleum products, which were up 35.98% year-over-year to $25.576 billion,

Exports of goods, which fell by $1.3 billion,

Imports of goods, which rose by $2.1 billion.

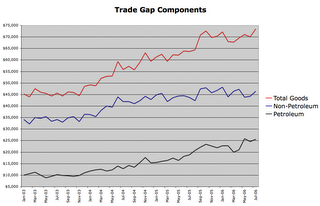

Looking at the longer-term trends that got us here, imports of petroleum products are really killing us. Imports of other goods still appear to be trending down, but petroleum imports are curving upward:

I don't buy the hype in the mainstream financial media that says the commodity boom is over. While we may be heading for some form of global economic slowdown, I'm inclined to believe that the growth engines of the developing world will continue to create heavy demand of industrial supplies. If nothing else, the huge foreign currency reserves amassed by China will allow them to continue purchasing industrial goods to build out their infrastructure in the face of an eventual export slowdown.

Net exports of services are now down year-over-year to a feeble $5.395 billion as our edge in knowledge and technology continues to decline. The main way we can hope to begin reducing the trade gap is to reduce our net imports of goods. For that to happen, the dollar must fall, but unfortunately the foreign currency markets are refusing to let that happen. After an initial dip, on today's numbers, the Dollar actually rallied back stronger against the Yen. Japanese and American governments and central banks seem unwilling to pull the plug on the Carry trade. It may be up to China to force the issue, after adding another $19.6 billion in trade gap dollars to their monstrous pile in July.

So another month passes, and Americans go another $68 billion deeper in debt. The longer the world puts off a substantial decline in American living standards, the ore severe that decline will eventually be.

<< Home