Economic Report Summaries

A lot of economic reports came out today, underscoring the deteriorating state of the US economy.

The Personal Income and Spending report showed that spending continued to grow faster than income, with a negative net savings of $83.5 billion for the month of July, or -0.9% of disposable personal income. That's a record, but the data doesn't even include mortgage interest payments. Mortgage debt service had risen from 9.04% of DPI in Q1 2000 to 10.49% of DPI in Q1 2005 to 11.41% of DPI in Q1 2006. That percentage is growing rapidly because this is the year of sharp adjustable rate resets.

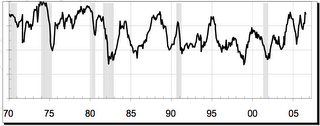

The Chicago Purchasing Managers' Index came out as well, showing a declining trend in employment and a rising trend in prices paid. The Fed can fight one or the other, but not both. Prices Paid are heading up toward levels not seen since the 70s:

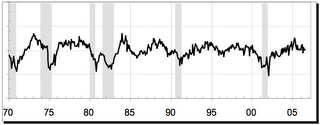

Employment appears ready to roll over and play dead:

The Kansas City Fed reported similar trends.

Initial Unemployment Claims remain subdued for now, although insured unemployment continues to rise. Tomorrow's employment numbers could reflect this.

Finally, the Fed's H.4.1 came out today, showing a big surge in Reserve Credit ($13 billion) just in time to goose the markets for this week's auctions and the close of the month. Meanwhile, official accounts shed a couple billion in treasuries, but with the big 2 and 5 year auctions this week they probably added a bunch at today's settlement that will show up next week.

<< Home