Rebalancing Takes a Step Backward

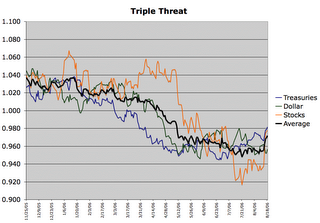

The Fed caught a breather on all three of the main threats it faces from the rebalancing process:

Options expiry week is always an interesting time in the market and with the rebalancing process underway it tends to be a time for the process to step back and let the risk underwriters reduce their pain. Not surprisingly, it wasn't a good week for the short side of the rebalancing trade:

It's a common trap for investors and traders to blame manipulation by the big boys when things don't go their way. Personally, I blame myself when I don't correctly predict which way the big boys will manipulate things.

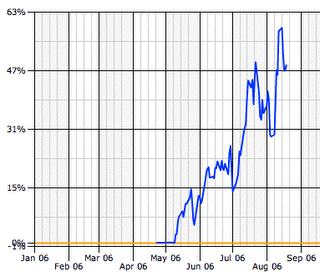

I see some interesting themes in looking at these charts of the Commitment of Traders data.

Commercials are the traders who take positions mainly for hedging purposes. As I understand it, the big broker banks tend to make up a large portion of the commercial position. If manipulation of the markets is taking place, then it could show up in the commercial position. The commercials also tend to be on the winning side of trades, because they are the ones who are big enough to influence the markets and manufacture their own good fortune. They make their bets, then make their bets successful, unless they try to push it too far.

Looking at commercial positions in various areas of the futures markets:

Currencies:

Euro = 15% bullish, choppy = Extremely Short

British Pound = 20% bullish, declining = Way Short

Swiss Franc = 65% bullish, rising = Long

Japanese Yen = 62% bullish, rising = Long

Canadian Dollar = 34% bullish, choppy = Short

Mexican Peso = 35% bullish, declining = Short

I tend to think the Euro is being held down by commercials. A lot of speculators probably bought the Euro and Pound on the recent pause by the Fed and surprise hike by the Bank of England. If the Fed starts raising rates again, it will probably boost the dollar relative to the Euro and give commericals a good exit.

Long the Yen? Perhaps betting that Japan will tighten more.

Short the Loonie and Peso? Perhaps they are related to the Euro/Pound as an dollar boosting story.

Commodities:

Crude Oil = 47% bullish, declining = Slightly Short

Natural Gas = 45% bullish, declining = Short

Gold = 24% bullish, flat = Way Short

Platinum = 16% bullish, declining = Extremely short

Silver = 24% bullish, flat = Way Short

Copper = 55% bullish, rising = Slightly Long

Speculation into Oil hitting $80 or $100 on the pipeline closure appears to be wrong in the short term. Commercials probably sold into the panic buying and will ride it out as traders give up and take losses. These are the widely traded contracts, so 47% can still be a big bet on the short side.

Bankers hate precious metals. They once were the bane of fiat currency and extreme credit expansion. Now fiat is here to stay, but bankers still hate them.

Equities:

Dow Industrials = 30% bullish, flat = Short

S&P 500 = 49% bullish, rising = Neutral

Nasdaq 100 = 55% bullish, choppy = Slightly Long

Nikkei = 43% bullish, declining = Slightly Short

Nasdaq took its lumps early in the bear market. Large caps towards the end?

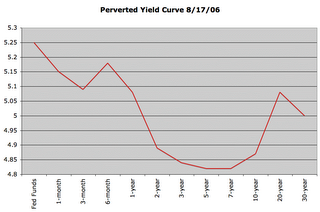

Bonds:

30-Day Treasury = 51% bullish, declining = Neutral

2-Year Treasury = 54% bullish, rising = long

5-Year Treasury = 53% bullish, choppy = Slightly Long

10-Year Treasury = 45% bullish, declining = Short

Treasury Bond = 55% bullish, choppy = Long

Here's our perverted yield curve, with the 2 and 5 year strangly down with the 30 held down too:

Speculative hedge funds may be betting on a return to a more normal curve in the mid range, leaving commercials to keep buying those durations, pushing down the yields. They don't have to be fundamentally right to win. They just have to last longer than the specs.

<< Home