The Financial Markets and Global Economic Rebalancing

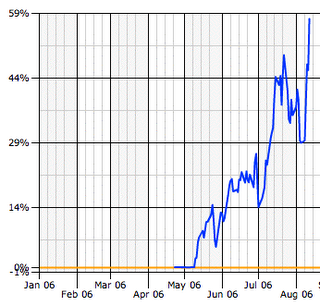

The Rebalancing Trade has had a pretty amazing run of late. Here's the recent performance of a leveraged, mostly-short account that makes up part of my rebalancing hedge strategy:

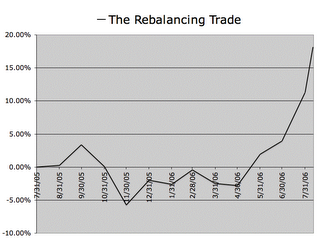

That account is balanced against another account that is mostly long and unleveraged. Combined, the accounts constitute the rebalancing trade, which has been working since November, about the time I estimate the global economic rebalancing proces reached an important turning point:

That account is balanced against another account that is mostly long and unleveraged. Combined, the accounts constitute the rebalancing trade, which has been working since November, about the time I estimate the global economic rebalancing proces reached an important turning point:

Some important disclaimers:

1. There has been a lot of luck involved, as well as a lot of time spent researching individual stocks, some active contrarian trading and a little bit of sector rotation. These results are a very crude gage of the overall rebalancing strategy.

2. Usually when I have a run of good fortune like this, it is quickly followed by a period of getting knocked on my behind by the markets. With that in mind, I reduce the overall risk and leverage in the accounts when they are having a good run. If anything, recent success should be viewed as a predictor of imminent failure in the markets.

3. The size of the accounts is relatively insignificant. I'm not rich, and I'm sure I'd be doing much worse if I had to manage millions of dollars over the long term. If I was managing a large amount of money, I wouldn't be sharing my thoughts on the markets for that matter.

4. I don't encourage anyone to try and duplicate my trading strategies. The stock market has a way of making sure the masses lose out. The more people trying to play the rebalancing trade, the more likely it is to fail.

That said, I believe that my recent good fortune adds evidence to the idea that the rebalancing process is well underway. I think that the markets have been demonstrating this strongly over the past 3 or 4 months and the charts above provide evidence for the main ideas of this blog.

In the 8+ years I've been trading stocks, there have been periods of time when I believe the markets have been moving away from what I consider to be reasonable valuations and periods of time when I think the markets have been moving toward reasonable valuations. That holds true for the market as a whole, as well as for individual sectors. As the rebalancing process still has a long way to go, I think it likely that the rebalancing trade will continue to work on some level.

<< Home