Consumer Credit Takes a Familiar Twist

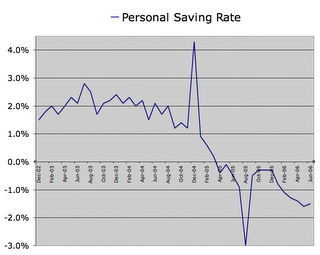

Consumer debt keeps piling up as the average American continues to spend more than he earns:

(Upspike was due to the big Microsoft dividend. Downspike was due to lost Katrina rent.)

(Upspike was due to the big Microsoft dividend. Downspike was due to lost Katrina rent.)Living beyond your means is easy when you measure your net worth by the inflated market value of your home. Throughout much of the past 5 years, homeowners have been consolidating their credit card debts into new home equity loans. Now that real estate prices are hitting the wall, home equity extraction is becoming impossible for many. Changing habits is a slow process, so for now, consumers are back to running up the credit card debt.

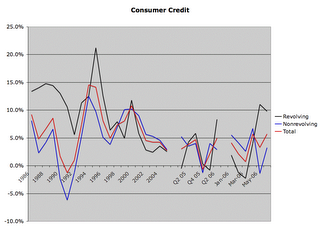

Revolving debt is spiking again, as it did leading to the economic slowdowns of 1990, 1995 and 2001. Consumers are getting squeezed and it is showing on their credit card statements. This will create a greater squeeze in the near future, and rising defaults will eventually bring revolving debt down again.

Meanwhile, consumers are starting to cut back on the big ticket items that usually get financed with non-revolving debt. (Nonrevolving debt includes automobile loans and all other loans not included in revolving credit, such as loans for mobile homes, education, boats, trailers, or vacations.)

Consumer Credit cycles are shown in the following (3-in-1) chart:

Pools of securitized, revolving, consumer credit continue to decline, while securitizations of non-revolving debt picked back up in 2005, mirroring a shift from unbacked US treasuries to asset backed Agency debt. Savvy foreign investors will want to claim some hard assets when the defaults hit. Even if they end up being worth a fraction of the original debts. Something is better than nothing, in return for financing the great transfer of wealth and production capacity out of the US.

Credit is not tightening yet because commercial banks are doing most of the financing now for revolving debt. The banking sector is already so extremely exposed to the great pyramid of debt, that it might as well front some more cash to hopelessly indebted consumers and book profits at 20% interest rates for just a little while longer. If you're an executive at a major bank, the long term risk is the shareholders' and the greater economy's and not yours. Since a big share of the profits goes into this year's bonus check you'd better take it while you can get it.

The same themes continue in consumer credit as in almost every other part of the financial sector:

Foreign investors skate off cleanly from high-risk, unsecured debt into asset backed debt.

American banks take on more risk to keep things afloat just a little longer.

US consumers leverage themselves deeper to put off default and bankruptcy.

It's as if the people in charge of the government and financial sector want the blow up to be as big and painful as possible in the good ole' USA.

<< Home