The Middle-Class Squeeze

Many middle-class Americans have been facing tighter budgets as food, energy and housing costs have been rising faster than their income. Democratic strategists are catching on to this and using it as a campaign theme, but they aren't explaining the root cause of the squeeze, which is the rebalancing process. Voters don't want to be told the part about how they have been consuming too much and saving too little. They'd rather hear the part about how Republican policy makers have been squeezing the living standards of the middle-class in order to boost the living standards of the rich. While the second part is valid, it doesn't diminish the importance of the first part.

Over Consumption

On average, Americans consume far more resources than the rest of the world. As a nation we most likely got in the over-consumption habit by having a great deal of productive land at our disposal with a relatively small population. Later, our economic and military dominance enabled us to exploit the resources of many developing nations. Recently, American over-consumption has come as a result of our taking on massive amounts of debt and selling off productive assets to foreigners at a rate of over $1 Trillion every two years. With consumption on the rise in developing nations, and America's financial and military influence on the decline, the level of consumption in the United States is likely to decline substantially in coming years.

Forced Reduction of Consumption

If Americans could become savers again, the rebalancing process could proceed without a forced reduction in consumption. Culturally and psychologically, that isn't going to happen. People aren't likely to voluntarily reduce consumption just because it is an economic inevitability. Most people will be forced to reduce consumption as a result of a decline in purchasing power in a changing economic landscape. Two of the main ways that this is likely to occur have already begun having an impact on American consumers. The rising cost of essential goods, like food, energy and housing, cuts into the quantity and quality of goods people can consume and greatly reduces their ability to buy non-essential items. Rising interest rates place a further burden on discretionary spending by increasing monthly expenditures for Adjustable Rate Mortgages and consumer debt service. Two additional factors that will lead to an even sharper decline in consumption have not yet begun and are currently prolonging the period of over-consumption. Easy access to credit from private banking institutions and record federal deficit spending have helped many Americans temporarily keep up high levels of consumption at the expense of their wealth and financial security. Viewed independently, all four of these areas might appear to to be short term, unrelated factors, but viewed in the context of a necessary decline in American consumption it becomes apparent both how closely they are all related, and why their convergence means we've reached an inevitable turning point that has marked the beginning of a long period of declining standards of living.

Who Gets Hit the Hardest?

Demographically speaking, the American middle class is responsible for the largest portion of discretionary spending and should therefore face the greatest decline in living standards. There are many poor, but their ability to decrease consumption without dying is less. The wealthy consume a great deal more, but their numbers are few and raising taxes isn't likely to slow their consumption much. Dividing the economic pie is a political game and there is little doubt that wealthy Republican supporters have been spared much of the pain as there people have been in control in Washington. Asset prices have soared while corporate profits and executive salaries have grown rapidly in the first part of this century. Meanwhile, working class and poor Americans have been taking on a disproportionate share of the pain as rising expenditures for heating, transportation, housing and debt service have cutting into already tight budgets. Going forward, there is likely to be much more pain to share (especially from rising energy costs) and political change is possible if there is enough outrage over declining living standards for middle and working class families. Whether or not the political focus shifts to providing a better safety net for the poor while raising taxes on the wealthy, the continuing Middle Class Squeeze will be necessary to reduce American consumption to ecologically and financially sustainable levels.

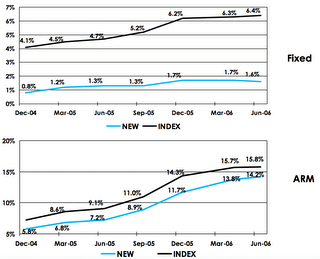

The following chart was provided today by New Century Financial, America's second largest sub-prime lender:

It shows delinquencies of 60 days or more for ARM and fixed rate mortgages originated in 2003. They boast about their delinquencies being lower than the industry averages, but the sharp rise up to 15% indicates conditions are rough for a rapidly growing segment of the population, and the ARM reset cycle is only just beginning. The pressure of the middle-class squeeze is causing one borrower after another to financially implode.

<< Home