Stock Market, Treasuries, Dollar, Oh My!

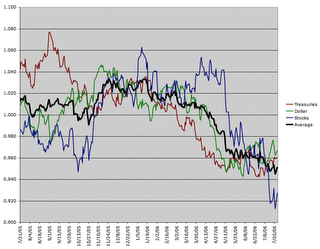

Since the rebalancing process got rolling the Fed has had to perform a difficult juggling act with the stock market, treasuries and the dollar. With the consumer driven economy beginning to sputter, and without enough support from foreign investors there is downward pressure in all three areas. Below I've include a chart I created based on data for 10-year treasury yields, the Dollar in Euros, and the Nasdaq-100. It provides a rough measure of the relative strength in the three areas and shows how the rebalancing process is eroding the wealth of American investors:

The average of the three stopped moving up in November, about the time I've chosen as the official start of the rebalancing process. Not surprisingly there was a bit of a lag before the financial markets felt the full weight of shifting capital flows. Beginning in late January, the average of the three started moving down somewhat rapidly, with treasuries suffering first, the dollar second and stocks third.

A typical diversified US investor does poorly if his stocks or bonds fall in price or if the value of his dollar denominated assets decline against other global assets. The investor might not feel it right away, but a declining dollar eats away at his wealth through inflation. That's my rationale for using an average of all three measures as a gage of how the US financial markets are performing.

The Fed doesn't want to see any of the three fall rapidly because it could cause a financial crisis. If treasury prices fall too rapidly then a sudden shock would hit the economy in interest rate sensitive sectors (although a long term decline could be just as damaging). Perhaps more importantly in the minds of the Fed chairman, a quick movement in interest rates could bankrupt highly leveraged derivatives players like JP Morgan and potentially cause panic in the derivatives markets. That would be really bad for bankers.

If the stock market takes a dive then the Fed will face trouble on several fronts. The economy will slow via the wealth effect. There will be a political uproar over falling stock values. Many hedge funds will get slaughtered, deleveraging the money supply as they go. The nation's pension plans will be exposed as horribly underfunded ponzi schemes, leaving corporations and government entities deep in the hole. The average working American would suffer greatly.

If the dollar falls rapidly, than the rebalancing process will accelerate and compound the Fed's problems with treasuries and stocks in the near future. Inflation will also pick up with the Fed taking the blame. If the dollar appears weak it could also trigger a flight out of US dollar based assets, again compounding the Fed's problems. Former Labor Secretary Robert Reich suggests that Hank Paulson gave up being CEO of Goldman Sachs to make sure the dollar's decline is orderly. I agree and think he has his eyes on interest rates as well.

All of the above problems will probably be felt to a substantial degree in time, but the Fed is hoping that none of them will be felt strongly enough to get people so upset that it undermines the power of the banking cartel. The best they can hope for is to let all three continue to decline gradually together. It appears that this is the way the Fed is playing things. Whenever one market gets dicey they talk it up at the expense of the others. When the dollar was falling, they began talking tougher about interest rates and inflation fighting. This caused longer term rates to rise, so they let stocks to fall with talk of a slowing economy and an eventual pause. Of course the Fed always understates the current level of inflation and overstates the long term strength of the economy, as false confidence is the main thing keeping the whole system afloat.

Allowing the money supply to grow rapidly has helped the Fed slow the rate of decline in stocks and bonds, but has created greater inflationary pressures for the near future. Increased liquidity has been the easy and short-sighted way to boost stock prices and pervert the yield curve (tomorrow's topic). Dollar weakness has been tempered by raising short term rates to attract foreign currency arbitrage players, but that will create even bigger problems when the arbitrage equations shift.

Based on the policy decisions of the Fed up until now, and the slowness of the rest of the world to realize the challenges of the rebalancing process, I'm expecting the stock market, treasuries and the dollar to accelerate their declines going forward. A financial crisis in the United States is not in the best interests of foreign investors or the global economy. Through awareness and teamwork the central bankers of the world could engineer the rebalancing process in a manner that minimizes financial turmoil. However, if the banks continue to try and protect their own narrow interests, the US and global economies could face dramatic shocks.

<< Home