Treasury International Capital Flows and a Fed Conspiracy Theory

When the treasury finally gets around to publishing TIC data, it is a month and a half old. It doesn't tell you what's been happening lately, but the trends can be clear and it helps explain what was happening a couple of months ago.

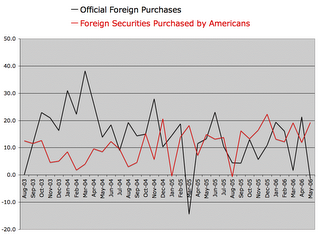

May was notable as the month the stock market started going down the tubes. It was also a month where Foreign Official holdings of treasuries fell by $16.6 billion (counting T-Bills) and official net purchases of domestic securities was negative for only the second time in almost 3 years of data (-$3 billion w/T-bills, -$1.4 billion w/o). This was an acceleration of a larger trend for official accounts toward selling off US treasuries and slowing long term asset accumulation. At the same time, the trend toward Americans investing more in foreign markets has accelerated:

To me this is an indication that the smart money has been fleeing out of US assets and especially US Treasuries.

Japan (who was a huge buyer back in early 2004) continued to reduce holdings in May. They are down to $637.9 billion in May from $672.8 billion in September, so who has been buying to pick up the slack? China ($3.9 billion), the United Kingdom ($8.9 billion), Oil Exporters ($3.7 billion), Canada ($4.6 billion) and Brazil ($2.3 billion) were the biggest purchasers of treasuries during May. China is working the trade gap and building up foreign currency reserves faster than any other nation. Canada, Brazil and the Oil Exporters are rich in resources and also big exporters to the US. But what about the UK, where treasury holdings have almost tripled over the past 11 months, from $58.8 billion to $174.7 billion???

I've seen a conspiracy theory floated around the web stating that the Fed has been buying up treasuries through secret hedge fund operations in the Caribbean. I don't know if the Fed is directly behind recent demand, but I'm fairly confident that hedge funds are involved. The Channel Islands or Isle of Man are included in the UK data and many hedge funds are registered there. Some of these funds have likely been borrowing many billions of dollars into existence and providing enough demand to keep treasury prices from collapsing. In the TIC data "private" investors boosted holdings, and that statistic gets trumpeted in the financial media, but most of this is probably newly created money that is being invested by hedge funds registered overseas.

Even with credit expansion in the consumer and housing arenas slowing, money supply growth continues at an amazing rate. Sure, M2 isn't growing very quickly but that's the money average Americans have in their savings and checking accounts. As we know, the average American has been feeling the squeeze of late. M3 growth, however, had been in the double digits. The Fed stopped counting M3, just as treasury holdings in foreign official accounts began shrinking and purchase in the UK and Caribbean banking centers jumped by a combined $24.1 billion. Is it just a coincidence that the Fed discontinued M3 when credit expansion via hedge funds was taking off?

Looking forward to June and July data, H.4.1 data published weekly suggests that official accounts went back into positive territory in June (as the markets stabilized) but flows turned negative again for the first part of July (and we know what's happened to the markets the last couple of weeks).

Tying this all back to the issue of rebalancing, it appears that the process is occurring from both sides at the same time. Just as consumers are hitting a wall, foreigners are slowing their purchases of US securities. As rates continue upward and the stock market continues downward the first obvious effects of rebalancing are becoming clear. The next stage will likely be for the US consumer economy to start to contract much more visibly and for inflation to rise even faster.

Newly created and foreign money is piling up in institutional accounts and earning a now-respectable 5-6% and this provides additional domestic demand for treasuries. So hedge funds appear to be funding the US treasury both directly and indirectly (by credit expansion). All this money growth is of course inflationary and inflation numbers continue to surprise the experts to the upside. Perhaps that's because the experts don't understand the rebalancing process.

Is there an easy way out of this mess? No, but the sooner we recognize the process underway and adjust appropriately the less the damage will become. We need to bring down the value of the dollar dramatically. We need to lower interest rates and tighten up credit standards. We need to brace ourselves for a chain reaction of defaults in the financial markets. We need to start investing in education, new technologies and infrastructure to keep the economy functioning. We need to quit pissing away money in Iraq. If we don't get a good start while we still have a functioning economy it will be much more difficult after the system crashes under its own weight.

<< Home