The Dollar and the Trade Gap

The biggest factor behind global trade imbalances is the overvalued dollar. Because it is so severely overvalued, foreign produced goods have a huge competitive advantage over domestically produced goods. Unwinding the trade gap will require a substantial decline in the value of the dollar in order to make US production more competitive.

The US dollar became overvalued for four main reasons, in my opinion:

1. Asian countries manipulated their currencies to boost the value of the dollar.

2. European countries kept interest rates low to make their currency less attractive to currency speculators.

3. The United States has pursued strong dollar policies to temporarily boost the standard of living of voters.

4. Foreign investors have a misplaced sense of confidence in US assets.

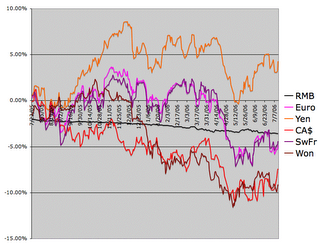

China maintained a peg of the RMB to the Dollar for many years. That peg was officially broken on July 22nd, 2005, but the following chart shows clearly that the dollar really hasn't been allowed to float freely against the RMB:

The fluctuation in the RMB/Dollar rate is nothing like the fluctuation of the dollar against other currencies. China's central bank most likely keeps a tight control on the fluctuation of the dollar, allowing it to decline at a snail's pace so that Chinese exporters don't have to endure much economic uncertainty.

Japan's economy hasn't been growing very fast since the Japanese stock and real estate bubbles burst in the early 1990s. Japan kept interest rates at 0% for years, which makes it attractive to currency speculators to borrow Yen at low rates, purchase dollars, then leave those dollars in interest earning accounts. While most other central banks have been raising rates for a year or more, the Bank of Japan has kept rates at 0%. Consequently the Yen has been one of the weakest currencies on over the past 12 months. With inflation picking up in Japan, there is much specualtion that Japan will start raising interest rates tomorrow, which would hopefully allow the Yen to strengthen.

South Korea intervened for a long time to keep their currency weak, but over the past year they've let the Won strengthen. Part of that may be politically motivated, as a way of boosting the standard of living of Korean consumers.

Canada's currency has been strong as the country is rich in commodities. In the inflationary environment of competitive devaluation (from everyone except the US), commodity prices have soared and the net worth of the nation of Canada has appreciated.

European currencies have strengthened considerably against the dollar over the past 3 months and 3 years, even though there was a long period where little change occurred. While European central banks would generally prefer weaker currencies, they then to be philosophically against overt manipulation in the currency markets, unlike their Asian counterparts.

The US Federal Reserve has led the charge in raising interest rates. The official reason given for continued rate hikes is to fight inflation, but I don't believe that works anymore in a banking sector that is guided by short term profit motives or with a financial system that can repackage and redistribute wealth to an endless array of unsuspecting bag-holders. Instead, I think rising interest rates are more about supporting the value of the dollar while also squeezing interest rate sensitive consumers to make sure they absorb most of the pain in the rebalancing process.

As the US consumer struggles and becomes less important to Chinese exporters, I'd expect China to focus more on exporting to Europe. If the dollar was allowed to simply fall against the Yen and RMB, then the long-term trend would be towards a stronger Euro against the dollar, but a weaker Euro against the Yen and RMB. However, I don't think Japan and China would want to let than happen, so the Euro likely will continue to strengthen against the dollar as well as Asian currencies.

The US Markets have long been a stable and reliable place for foreign investors to put their capital. Because of this many foreigners still have misplaced faith in the US financial system. The US government is bound for bankruptcy and while nobody in the media seems to recognize that yet, foreigners have begun shying away from treasury bonds. The housing market is in a dangerous bubble state, so Agency debt is risky as well. The most popular sector for foreign investment of late has been corporate bonds, which are arguably safer than US equities because bankrupt firms will eventually be transfered into the hands of bondholders. It will take a long time for investors to fully adjust to the sad state of the American economy, but reality should eventually be reflected in both the markets for US assets and the value of the dollar.

Currency speculators are a major factor in the short term pricing of the dollar. They played a large role in the decline of Asian currencies in 1997 and in Argentina more recently. By propping up the dollar with higher interest rates the Fed is playing with fire. The short term flows into the dollar can eventually reverse and cause a much greater dollar crisis down the road.

For the above reasons and more, I expect the dollar to decline substantially over the next several years. Gradually this should reduce the ability of Americans to consume while also improving the competitiveness of American exports. If policy can be developed with the harsh realities in mind, then the process doesn't need to be very painful. However, based on the recent actions of our political and financial leaders, the potential for a painful economic crisis is very high.

<< Home