Foreign Investment and the Trade Gap

Excessive consumption in the US is one half of the trade gap problem. The other half is excessive foreign investment. US assets are not a good long term bet for most foreigners, but as long as sufficient demand persists the dollar can stay strong and the trade gap can continue. Much of the demand for US assets comes from foreign central banks, but that demand has been drying up. Not surprisingly, the US financial markets are struggling from a lack of foreign support.

In 2004, the Bank of Japan went on a big US treasury buying binge as part of a campaign to weaken the Yen. However, Treasury data shows that Japanese monetary authorities and investors have begun selling off US treasuries since last September. Total foreign holdings of treasuries declined in April, marking the start of substantial declines in most US asset classes. Indeed, TIC data shows that purchases that for foreign demand for all major forms of US assets declined in April.

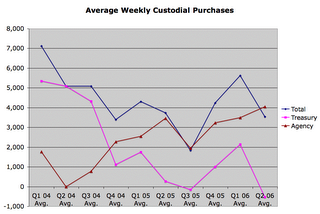

The fed publishes "Marketable securities held in custody for foreign accounts" every Thursday afternoon:

Over the past 52 weeks (7/05-7/06),

U.S. Treasury holdings were up $20.564 billion

Federal Agency holdings were up $169.367 billion

In the prior 52 weeks (7/04-7/05),

U.S. Treasury holdings were up $95.679 billion

Federal Agency holdings were up $112.937 billion

In the 52 weeks prior to that (7/03-7/04),

U.S. Treasury holdings were up $239.555 billion

Federal Agency holdings were up $53.126 billion

The following chart shows the decline of treasury purchases and the rise in agency purchases over the past 10 quarters:

Foreign central banks have lost interest in US treasuries and shifted their appetite to Agency debt (Fannie Mae's and Freddie Mac's mortgage backed securities). In my opinion they are doing this because they expect that US treasuries will eventually be worthless and would prefer to invest in something that is actually backed by hard assets.

Agency debt has Fannie's and Freddie's guarantees that payments will be made, but those guarantees are only as good as the cash position of the two gigantic GSEs. The leverage on trillions of dollars worth of mortgage backed securities could easily wipe out the GSEs if housing prices return to trend and enough borrowers default.

With data showing foreign investment is in decline, the biggest question becomes one of WHO is picking up the slack and buying new treasury issues and other types of US assets? Of course I have my theories, but those will be the topics of future blog entries.

<< Home