The Great American Ponzi Scheme

In a Ponzi scheme money from new investors is used to pay off earlier investors. In many ways, the American economy resembles a Ponzi scheme. While there are many productive American asset classes capable of generating positive returns on their own, the economy has grown increasingly dependent on the creation of new debt as a way of paying debt service on existing debts. The system really hasn't been tested yet, but we may have already reached a point where Ponzi finance is required to postpone an economic meltdown.

Trade Gap and Gross External Debt

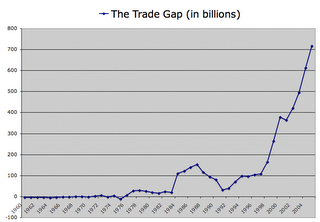

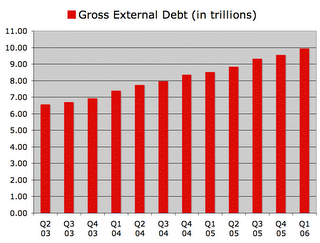

The following two charts show the dramatic expansion of the Trade Gap and Gross External Debt to foreigners.

As the size of our debt to foreigners has increased, interest payments on that debt have also increased. These payments would have been a very large drain on our economy if we hadn't been able to continue borrowing more new capital each year. Thanks to Ponzi finance, the nation has been able to pay existing debt service by borrowing additional funds from new foreign investors. The system is already being tested as foreigners have been slowing their pace of new investment into the United States. The scope of this test will likely accelerate and the results of this test will likely involve a simultaneous decline in the value of the dollar, the amount of US consumption, overall economic activity, and the price of US assets. My expectation is that the US economy will not handle this test well.

Federal Deficit and Debt

As of 6/30/2006, the Federal Debt was $8.42 trillion and growing rapidly. So far the Federal Government has run up a deficit of $206 billion, but that lowball estimate treats money looted from the Social Security and Medicare trust funds as revenues. Counting that money, the national debt has grown by almost $500 billion over the first 9 months of Fiscal 2006. Counting accrued benefits to veterans and civil service workers and many other promises-the-government-won't-be-able-to-keep, the true yearly deficit is well over $1 trillion.

Interest payments on the national debt will total over $400 billion this year, up from about $350 billion last year. Thanks to Ponzi finance the treasury has been able to pay off old investors with new bond sales and accounting fraud. As the system gets tested, we can expect yields on US treasuries to rise (as they've been doing for the past 3 years) until the government finally has to default on its debt in one form or another.

Social Security

Social security was designed to function like a Ponzi scheme where funds collected from the current workforce were used to make payments to current retirees. Over time it was supposed to build up enough of a trust fund that it would shed its Ponzi nature. Because of demographics, the large baby boom generation generated revenues for the system and kept it solvent. Within the next few years, enough baby-boomers will begin collecting benefits that the Ponzi nature of the system will be severely tested. However, we might not even get to the point where this solvency of the system gets tested. Roughly $3.6 trillion has been taken from the Social Security and Medicare trust funds and has already been spent by Congress and the President. The solvency of the Federal Government should fail its test well before the Social Security and Medicare trust funds run out of money.

The Stock Market and Other Pension Plans

Public and Private pension plans across the nation face similar problems to the Social Security system. Boomers and their employers stuffed money into these retirement plans at a time where demand for investment options was high and prices were inflated. When plans have to sell off assets to meet the retirement needs of boomers, prices can be expected to be residing at relatively low levels.

On average, public pension plans are about 15% underfunded based on current asset prices. As the reality of Ponzi finance takes hold, I expect plan managers will come to realize that conditions are much worse than they've been expecting. For public plans, like the massive state employee and teacher plans, the Ponzi principle will be stretched even further as new employees are called on for greater contributions in order to meet the promises made to retirees. Meanwhile many corporations are looking for ways to avoid responsibility for servicing their own plans, often by transferring the burden to the government through the Pension Benefit Guarantee Corporation. If you read the news with a critical eye, you'll see that pension plans across the nation are already failing their test and being exposed as Ponzi schemes.

The Tech Bubble

The tech bubble was an example of Ponzi finance that already failed for investors. It was largely fueled by hordes of investors and mutual funds piling into the same groups of money-losing tech stocks. While the scheme was working, capital from new stock and bond offerings was keeping the companies afloat and fund managers were collecting hefty fees based on inflated asset values. Meanwhile profitable companies were temporary beneficiaries of huge capital flows into the sector. As the flow of new capital dried up, many companies began to fail and profits shrank for others. As investors tried to pull money out of these stocks they learned the lessons most Ponzi investors eventually learn: that the gains from underlying assets are an illusion and that only the quickest investors to exit will be the only ones to get their funds back.

The Hedge Fund World

Many hedge funds are like high tech mutual funds on steroids. They employ highly leveraged strategies where they borrow vast sums and pile the money into a given asset. Their growth over the past few years has been tremendous and this growth has guaranteed exceptional returns on paper. As they've gobbled up large positions in small cap stocks and thinly-traded (or not traded) derivative instruments they guaranteed their own short term success. The gains are mostly just on paper, yet this allows them to extract huge fees from investors. Returns have been leveling off for the hedge fund world as of late. Like any good Ponzi scheme, a falloff in returns will lead to a loss of investor confidence, and a rush of redemptions will then lead to a failure of the scheme.

Derivatives Markets and Underwriters

Big Wall St. underwriting institutions like JP Morgan and Citigroup have made huge profits by purchasing risk on the derivatives markets. They've stabilized the bond and other markets so far by selling derivative insurance products. The more they derivatives the sell, the more other financial institutions are willing to buy and hold mortgage, treasury and other debt. This keeps yields down, ensuring that JPM and C don't lose on their bets.

As debt levels have risen, the big underwriters have had to taken on escalating levels of derivative exposure to keep rates stable. Perhaps the bond markets can avoid a meltdown that would in turn wipe out many large derivatives players. Personally I think that US treasuries are heading for a massive default, and this will expose the Ponzi nature of the derivatives markets.

Consumer Credit and the Mortgage Market

A good portion of the rise in gross external debt has been a result of consumers piling on more and more debt. Financial Obligations Ratios have hit a record high as a large number of consumers and homeowners get pushed to the limit. Without really understanding the dynamics of it all, many consumers have been running their own Ponzi schemes with mortgage investors as the eventual victims. Many consumers lived beyond their means by running up large credit card balances and other forms of consumer debt. Some of them avoided default by "consolidating" this debt into larger mortgages. These mortgages got sold off to investors in a process of easy credit that drove up demand for homes. However, many consumers and homeowners are hitting the wall. Consumer spending has leveled off and legions of over extended borrowers are being forced to put their homes on the market. Home prices have stagnated, eliminating cash-out refinancing as an Ponzi finance option for a growing group of debtors. When the ability to borrow more reaches an end, a Ponzi scheme collapses.

Summary

Gross External Debt and Trade Gap are good indications of a grand Ponzi schemes that have spawned many other schemes within. Foreign investment pouring into the economy has gone into treasury debt, or mortgages, or corporate bonds, or the stock market or real estate, or any number of other tangible assets. Foreign investment also has created large numbers of jobs that can disappear almost as quickly as foreign interest in American Ponzi investment schemes. I think that all of the individual Ponzi schemes are doomed to fail under their own weight, but if foreign investment dries up substantially, the other schemes should fail more more quickly.

One thing the US has going for it is that it has the potential to rapidly devalue its currency and therefore the significance of its dollar denominated debts. The debts levels, however, are so high that the extent of devaluation would need to be substantial.

The other thing going for the US is that it still has a large quantity of productive assets that can generate a portion of the returns needed to service the growing debt burden. The longer the Ponzi finance schemes continue, the harder it will be for debts to be serviced, if indeed they ever can be without further extension of the Ponzi model.

The period from 1987 to 1991 was the last time we saw a substantial decline in the size of the trade gap. That period also saw a substantial decline in the value of the dollar and a painful recession. Of course the United States was still a creditor nation back then and the yearly trade gap was much smaller. This time it will be much more difficult to reduce the size of the trade gap and the economic pain will probably be far greater.

<< Home