And Now For Some Good News

The good news is that the economy is creating lots of jobs. If we are going to make it through the rebalancing process without going into a depression, keeping the number of jobs up will be important. Some sectors (housing, mortgage lending, retail) will likely suffer, while others are likely to grow.

Many blogs and websites in the Economics Underground downplay the strong growth in the job market. There is a deep rooted and justified mistrust of government statistics, which are often manipulated for political purposes. Nevertheless, I believe that the numbers of jobs being created are more or less legitimate. The change in methodology to add the Birth/Death Model gave W some artificial job gains to boast about in the 2004 presidential campaign, as a previously uncounted category of hypothetical jobs was added to the totals. But now the model is just a seasonally based guess at the number of new jobs that won't be reported to the goverment until the next July or January. People who try to claim that the economy is actually losing jobs because of the B/D adjustment don't understand how the number is derived.

What is more important to me than the total number of jobs is which sectors are seeing the job growth:

The Oakland Police Department is hiring. They have a huge banner on their headquarters facing highway 880. With the murder rate up 80% in Oakland over last year there is definitely a need for more cops. The San Francisco Police Department is running ads on local buses looking for new cops. An SFPD dispatcher I know says the most calls they receive are for relocating homeless people from people's doorsteps and for suspected terrorism tips (i.e. 4 Arabs in a car together). The prison population in the United States rose by about 1000 inmates per week from 6/30/04 to 6/30/05 to reach a total of 2,186,230. Sounds like law enforcement is a growth industry.

Other sectors are growing too. Mining jobs increased by 9.6% from 6/05 to 6/06, which isn't surprising given the huge demand for raw materials coming from China. "Rip it and ship it" should be a growth theme as the rebalancing process continues.

Then there's real estate, which added 52,300 jobs in that same time period. Good thing there are now over 1.5 million people working in real estate because selling a home is becoming very hard work. Whether anyone can actually make a living selling real estate will be the interesting thing to see.

Retail jobs are down, year over year, and that situation is probably going to get much uglier. One way or another, US consumption of imports is going to have to decrease relative to exports.

In spite of the strong job market, many (I believe most) workers are losing ground to inflation. Official government statistics show compensation rising as fast as inflation, but I believe actual inflation for working people is understated and compensation is overstated when you factor in stealth cuts like higher insurance co-payments and the elimination of some retirement benefits. At the same time, debt service is on the rise, so consumers aren't able to consume as much as before.

I'd get all worked up about this if I didn't think it was necessary. Working people may be bearing the brunt of the rebalancing effort for now, but soon enough everyone will be feeling it. Having the pain felt most by the masses will get them to consume less, while getting more of them to recognize how the political establishment is working against them. Hopefully a future administration can figure out how to make sure more wealthy people feel their share of the pain.

If the job market heads south then it will hurt the housing and financial sectors the hardest. I've heard executives from more than one mortgage based company say that job losses are the big factor that leads to rising defaults. Most people can survive a squeeze by cutting back on consumption. They usually can't survive a prolonged job loss with their mortgages intact.

In my mind, the key to a successful transition will the the rebuilding of our manufacturing base, which has been largely dismantled after years of increased outsourcing and importing. After a long, steady decline, manufacturing jobs have recently picked up a little. When the dollar finally does start declining, and we begin unwinding the trade gap, we will hopefully be able to create enough manufacturing jobs to keep people occupied and make up for lob losses in other areas.

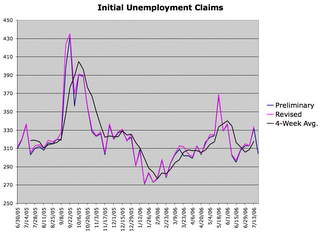

I continue watching weekly employment numbers to get an early indication of what's going on in the total job market. Ignoring the large blips from Katrina and the Puerto Rican shutdown, initial claims were trending down in 2005 and have began trending up in 2006. I'm expecting the trend to continue upwards, given the way things have been heading in housing and retail:

<< Home