The Housing Bubble and the Global Rebalancing Process

Mike Shedlock ran a letter from Florida realtor Mike Morgan in his blog today that does a great job of summing up much of what is wrong with the housing market these days. Please go check it out.

The bursting of the housing bubble is old news compared to the rebalancing process, but the two are inextricably intertwined. Excess foreign investment capital flowing into the mortgage market helped spawn the biggest housing bubble of all time. At the same time, the imagined wealth created by the housing bubble and the ease of cash out refinancing allowed consumers to live far beyond their means. As the rebalancing process unfolds, the damage will be especially great in the housing sector.

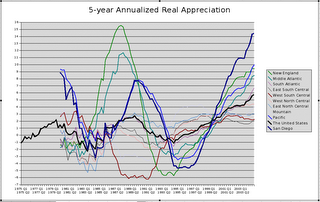

The first chart below adjusts 5-year annualized appreciation for inflation to show how much bigger this housing bubble has been on a national scale than any other housing bubble in recent history. (I did it a year and a half ago, so it doesn't include the last 6 quarters):

In inflation adjusted terms the nation has seen significant declines in housing values over multi-year periods, and certain areas have seen severe declines. The next chart is not adjusted for inflation, and if you fail to do that mentally you might be misled into thinking this bubble isn't as bad as the bubble of the late 1970s. Two main things it does demonstrate are how the bubble has been a national phenomenon and that we hit a final national peak of 9.44% for 5-year annualized appreciation. There is a very long way for prices to fall from here.

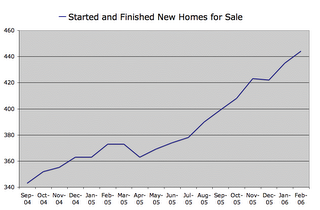

Because so much easy money was flowing into the housing sector, and because they are incredibly greedy, homebuilders went on a land acquisition and building binge that has been producing about 500,000 more new homes than the country has needed per year. Inventory is the biggest problem in the housing market, and we haven't come close to the inventory peak yet:

Because so much easy money was flowing into the housing sector, and because they are incredibly greedy, homebuilders went on a land acquisition and building binge that has been producing about 500,000 more new homes than the country has needed per year. Inventory is the biggest problem in the housing market, and we haven't come close to the inventory peak yet:

The severity of the housing bubble was obvious a year and a half ago, as was the unsustainability of the trade gap. All you had to do was look at the right data with a critical eye. The national press is gradually waking up to the reality of the housing bubble, although the news will get much worse. Global rebalancing isn't even on the radar of the major media yet, but I believe the overall impact will be even greater.

<< Home