Hedge Frauds and Pirate Equity

I suspect that hedge funds and private equity funds are the answer to one of the biggest mysteries of the current rebalancing process: Why are components of M3 growing at a rate of about 10% even though consumer and mortgage debt have slowed their growth?

Hedge Funds

Most classes of hedge funds, including private equity, borrow great sums of money into existence in order to leverage their strategies. Part of this is because many hedging strategies are low risk and low return by nature, and extreme leverage is the only way to make the trade strategies viable. Another part of this is because the hedge fund compensation scheme rewards managers for taking large risks with their clients' money - managers collect a large percentage of paper gains, but losses are born totally by investors.

The money borrowed by hedge funds flows directly into the financial markets as securities are traded and typically ends up in an institutional money market account somewhere. These accounts mostly purchase treasury, agency or corporate debt to fund government spending, mortgage borrowing or corporate activities like share repurchase programs.

Hedge fund activity is key to meeting the short-term needs of government and the stock market, even though it introduces great long-term risk into the total economy. Hedge funds can be wiped out in a short amount of time. The leverage they employ can result in fantastic paper profits, or it can result in rapid losses. The story of Long Term Capital Management is an important cautionary tale. If not for a $3.5 billion rescue package arranged by the Fed, over $100 billion in borrowings by the firm would have been repaid or defaulted on as the firm liquidated its holdings.

The hedge fund world has grown manyfold since 1998, with about $1.2 trillion in estimated assets now under management. Many funds have been employing high-risk strategies in the attempt to generate attention grabbing returns, boost their assets under management and collect large fees. In a volatile market, the total amount of assets wiped out and the size of the margin calls could be much larger than those faced by LTCM alone. While the money supply and economy have benefited from the growth of the hedge fund world, the potential for a rapid contraction is increasing all the time.

Most hedge funds performed well when the yield curve was steep and borrowing costs were low. When rates began rising in 2004, returns began declining. Hedgefundresearch.com has an index that estimates average hedge fund returns of 13.39% in 2003, 2.69% in 2004, 2.72% in 2005 and 2.19% so far in 2006. At best, those returns fail to keep up with inflation and benchmark indices. At worst, those returns are inflated by accounting tricks and increasing leverage and risk.

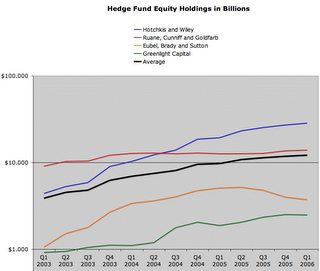

The rapid growth rate of 2003 has tapered off for many hedge funds, partly due to diminishing returns, partly due to declining investor interest and partly due to limited investment opportunities. The following chart, based on SEC filings, shows how growth has slowed for 4 large funds that I track:

Private Equity

Private Equity funds are currently the hottest area of the hedge fund world. They are generating tremendous liquidity and boosting asset prices through their leveraged buyout operations, but this is only a temporary benefit. Soon the wreckage left behind by private equity funds will be a major problem for the economy.

A leveraged buyout (LBO) occurs when a party borrows enough money to purchase all of the shares of a publicly traded company in order to take it private. LBOs introduce a lot of new money into the money supply and the stock market, but the newly private companies operate under a massive debt load and are vulnerable to economic downturns.

Leveraged buyouts are becoming hot again, as they were in the early 1980s, but there are some big differences this time. Back then, after the long bear market of the 1970s, beaten down stock prices made many companies a bargain for buyout firms and management teams. Executives could also run the stock prices into the ground with negative news and earnings reports and then make buyout offers at low prices. After the buyout was complete, the companies would suddenly become much more profitable and the executives would become extremely wealthy. Hostile takeovers became common for companies with low share prices as outsiders sought to exploit the situation whenever management didn't have the guts or gall to do it themselves, and "greenmail" became popular as a way to extort company money when management teams didn't want to give up their control of a company.

The LBO game worked extremely well for several years, but as the size and quantity of deals increased, and as market valuations rose, the profitability of LBOs declined. Buyout teams went for increasingly risky deals as competition among them increased and suitable targets decreased. Spectacular blow-ups late in the cycle caused a huge scandal, leaving many junk bond investors holding the bag and landing key players in jail.

The early success of private equity firms in this cycle was largely achieved on merit. As more firms have entered the arena, they are engaging in more questionable deals. Now stock prices are much higher in terms of price to earnings and other valuation measures, and good targets are becoming harder to find. To make an LBO profitable private equity firms need to exploit other victims, rather than just existing shareholders. The new LBO strategy is to find a company that has a lot of cash or assets that can be easily sold. The LBO team borrows enough money to buy out existing shareholders, then lays off employees, neglects maintenance and customer service, and otherwise destroys the long term value of the company in order to milk as much cash as possible. The exit strategy for private equity firms is usually to take the remains of their company public in a big IPO. As long as there are unsuspecting mutual fund managers out there who are either oblivious to the rules of the private equity game or who think they can run up asset prices in the short term, then private equity firms can exit unscathed. They take their profits and move on to the next set of victims.

However, a big problem is brewing in the private equity field as more and more firms enter the game. Pension plans, desperate to make up for poor returns of the past 6 years, are foolishly investing billions of dollars in private equity schemes late in the cycle. The number of IPOs will grow too large, just as it did when the technology bubble burst in 2000. There won't be enough clueless or greedy buyers for the IPOs. The results will be very bad for pension funds, the stock market and the economy as a whole.

<< Home