The economy shed 1,266,000 jobs in July, which normally is a big month for layoffs. Seasonally adjusted the economy supposedly gained 133,000 jobs, but seasonal adjustments don't make mortgage payments. Here's a chart showing unadjusted jobs numbers:

Things to note:

Jobs normally grow slower from July to January.

Jobs started going downhill in 2001, and didn't rebound until 2004.

2004 numbers started using the Birth/Death adjustment to boost totals.

Certain sectors are likely to contract as a result of the rebalancing process, like retail, consumer credit and construction. Areas which saw seasonally adjusted job declines in July include:

Residential specialty trade contractors: -9,300

Motor vehicle and parts dealers: -2,600

General merchandise stores: -8,200

Real estate and rental leasing: -2,900

While many realtors still have jobs, few are making a good living these days. I'm afraid the jobs slowdown is only just beginning, and people without jobs generally can't make their mortgage payments or buy luxury items. Defaults were already rising based on interest rate resets, but jobs losses traditionally have a much larger impact.

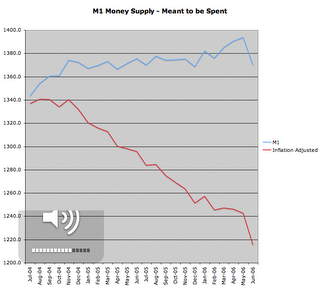

Here's a chart of M1 money supply, which roughly measures the money that people intend to spend soon:

The portion of money in people's pockets (and checking accounts) has begun contracting. Normally this money grows steadily with inflation and population. The inflation adjusted number gives a crude estimate (-0.5% adjustment per month) of what is really happening to the accounts of the average American. People are getting squeezed and this will ripple through the entire economy over time.

<< Home