Housing Vacancies

Americans aren't just over-consuming electronic toys and gadgets. They're also over-consuming housing. Thanks to foreign investment in Mortgage Backed Securities, there has been plenty of easy credit for people wanting to purchase more home than they can afford, and plenty of easy financing for builders who want to boost construction. The average size of new homes has increased substantially in recent years, and the number of vacant homes on the market has been climbing rapidly.

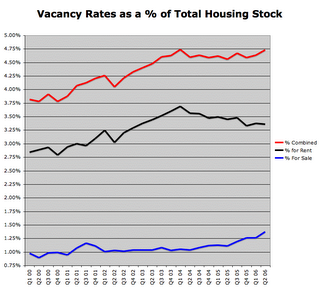

In the introductory post of this blog, I provided a chart showing how the trade gap, economic growth and the dollar were all related. In 1987 the trade gap was reaching a short term peak, with the economy overstimulated and the dollar poised for a sharp decline. Housing vacancies were also peaking at that time, and those same conditions are setting us up for an even bigger economic decline going forward.

Rental Vacancies peaked at 8.1% in Q3 1987.

Homeowner Vacancies peaked at 1.9% in Q3 1989.

There was a huge stock market crash in 1987 but the economy didn't slow dramatically until the 1990 to 1992 period when the housing market slowed nationally. There is a wealth effect that goes with stock market bubbles but housing bubbles involve far more real jobs and much more credit expansion. When housing bubbles burst, they have a bigger impact on the greater economy and a slowing economy further suppresses housing prices.

Fast forward to the present situation.

Rental Vacancies peaked at 10.4% in Q1 2004.

Homeowner Vacancies set a record high of 2.2% in Q2 2006.

There are many reasons to fear an even greater economic slowdown starting in 2006 based on a more dramatic rise in home prices and extreme private and national debt levels.

(Vacancy data can be found here.)

Looking just at the vacant homes that people are now trying to sell or rent, it becomes clear that too many homes have been built in recent years:

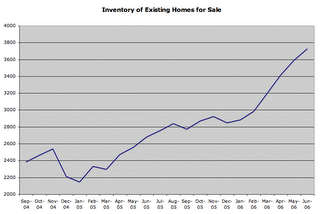

Housing price appreciation led to speculation, which led to increased construction. Prices have begun leveling off and now mortgage rates are putting the squeeze on homeowners who took on too much debt. 2006 is a big year for adjustable rate mortgages to reset, including 3-year ARMs that were popular in 2003, 2-year ARMs that were popular in 2004, and teaser rate mortgages that were popular in 2005. Delinquencies, defaults and foreclosures are on the rise throughout the country, and the number of homes on the market is spiking:

Supply and demand issues will lead to a substantial real decline in the value of housing. Distressed borrowers continue to add to supply (and I count both homeowners and homebuilders in the distressed borrower category) and a decline in the excitement around housing continues to cause a decline in demand. The housing market will get much worse before it gets better.

This is all an unfortunate and painful part of the rebalancing process. Over-consumption of housing went along with the rise of the trade gap as the result of easy credit for Americans. People foolishly saw purchasing a large home (with little down) as an investment, In truth, buying more home than you need is both speculation and consumption. The wealth effect of rising home prices over the past 10 years has helped fuel excess consumption. As housing prices decline, US consumption of imports should also decline because homeowners won't have access to the lines of credit that rising equity provided.

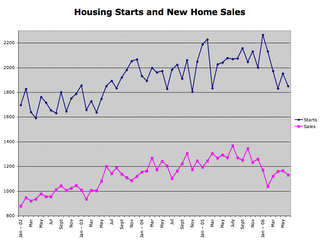

Homebuilders have too much land on their books, and rather than eating their losses, many are still trying to rush new homes onto the market and hoping buyers will materialize. The number of Spec. homes being built is rising rapidly, as new home sales are off about 25% from their highs, but housing starts are only off about 10%. Until we see starts dropping down below a 1.5 million annual pace, the vacancy problem will continue to grow.

Eventually, however, builders will slow construction to the point that demand can catch up with supply. This will have a chilling effect on the economy, as it did in the 1990 to 1992 period. That's just one small example of how the mounting global imbalances of the past 30 years are going to take a toll on the American economy. Many more will be detailed on this blog over time.

<< Home