Who's Buying Treasuries These Days?

The treasury has been issuing a large amount of new debt recently as July and August are slow months for tax revenues. Total debt went from $8.420 trillion on 7/28/06 to $8.460 trillion on 8/10/06, with another big chunk being funded on 8/15. With Japan and Korea reducing their treasury holdings in recent months, it appeared that the Treasury would have a difficult time and rates were likely to rise. Finding buyers for the upcoming auctions was probably on somebody's agenda for the G-8 meeting in Russia July 15-17.

The auctions have gone surprisingly well, even though President Bush failed to make new friends in Moscow. Indirect bidders have taken a good percentage of the debt, and foreign official and international accounts have surged in the past 3 weeks. So the question that comes to mind is: Has the foreign investment part of the rebalancing equation been put on hold?

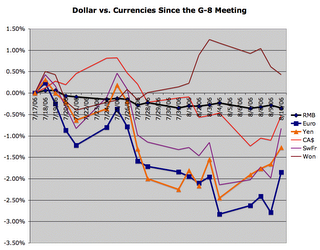

To try and answer that, I want to know who is doing the buying. The Major foreign Holders report for July won't be out until mid-September, so I look for clues in foreign currency fluctuations:

Of the main currencies I track, only the Won is up since the G8 meeting. Perhaps the South Korean central bank decided to boost treasury holdings. The Korean national pension fund recently said they be buying fewer US treasuries and more agency debt in the future. Interestingly, agency holdings declined by the most since the last week in March of 2003.

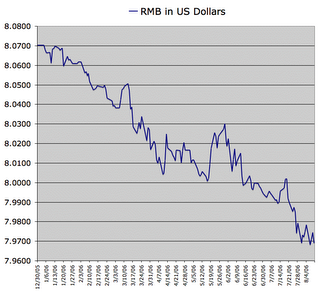

China added $15.3 billion in treauries through the first five months of 2006. The Chinese currency began it's sharpest rise against the dollar at the end of May (see chart below), so it may be that they've already joined Japan and South Korea in shunning US treasuries.

The other main candidates would be whoever has been snapping up treasuries in the UK and Oil Exporters. The UK gobbled up $28.7 billion in treasuries through May (probably hedge funds), and oil exporters increased treasury holdings by $24.6 billion during the first 5 months of the year, while Japan was reducing holdings by $31.1 billion. No doubt oil exporting countries are rolling in surplus dollars these days. The Saudis may have gotten a friendly phone call from the new bond salesman from Goldman Sachs. The Hedge Fund angle remains just a theory because hedge funds don't typically disclose their holdings or who's giving them money. To me it seems most likely that puppet governments in the Middle East and puppet hedge funds in the Channel Islands have been doing the buying ever since the legitimate buyers got wise and began an orderly exit from the market. Both of those groups may have custodial accounts at the Fed. I remain skeptical other foreign holders have decided to reverse course in the last 3 weeks. We'll know more in a couple of months.I don't think Korea, China or Japan have been big buyers, which leaves two main candidates:

<< Home