Fed Marks a Turning Point

The statement came out with the usual BS, blaming the slowing economy on a cooling housing market and rising energy prices while giving themselves credit for past rate hikes:

"Economic growth has moderated from its quite strong pace earlier this year, partly reflecting a gradual cooling of the housing market and the lagged effects of increases in interest rates and energy prices."

They try to make the case that they've done enough tightening already to tame inflation going forward, even though inflation is clearly accelerating:

"inflation pressures seem likely to moderate over time, reflecting contained inflation expectations and the cumulative effects of monetary policy actions and other factors restraining aggregate demand."

While it's customary for the Fed to give reasons for their actions, those reasons don't amount to much. They could have looked at the same data and hiked rates or cut rates and come up with a rationale after the fact. As is usually the case, the Fed took their marching orders from Wall Street and did what was best for bankers.

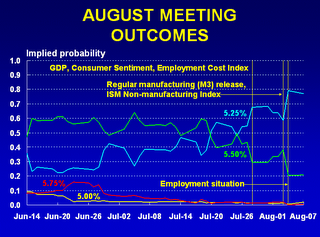

The fed futures called for keeping the Fed Funds rate at 5.25%, so the Fed obliged today.

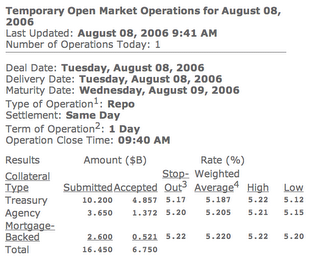

The primary dealers chimed in this morning as well, with a stingy set of bids on the Temporary Operation.

So the "pause" appears to have been a done deal, but the real question is one of why Wall Street wanted the Fed to stop hiking.

The dollar had been slipping a little, but not falling outright, with custodial accounts building back up a little over the last two weeks. So there wasn't much urgency for higher rates on the Forex front.

Treasury yields had been dropping and stocks had been stable, so there wasn't any urgency for an actual rate cut.

The upstart mortgage bankers have been clamoring for an end to the hikes for a long time, and are reporting a spike in delinquencies this quarter, but the Fed hasn't really cared about that so far, so I don't think they really cared about that this time.

Wall street's bread and butter has been the trading activity generated by hedge funds, and they had another bad month. Fear of more failures could have been the straw that led bankers to halt the rise in hedge fund borrowing costs.

While this is being billed as a "pause," I think it more likely that this is marking another key turning point in the rebalancing process. Heavy inflation will probably stay with us, as that is a way the country can shortchange foreign investors and preserve more wealth for Americans. The economy and financial markets, however, are likely rolling over slowly like a massive oil tanker. Once the process starts, it probably can't be stopped.

It may or may not be the end of rate hikes, as the status of the dollar is a key factor there. It probably is the end of the current economic expansion, for better or worse.

<< Home