Foreign Official and International Accounts at the Fed bought up over $25 Billion in treasuries over the past month, bailing out the treasury and contributing to a sharp decline in long term yields. Nice work, Paulson!

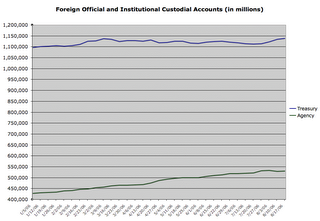

Just as in February, they came through when the US government was most desperate for cash. Unlike in February, however, this time foreign buyers stopped buying Agencies while they were gobbling up treasuries. Except for the February and August surges Treasury demand has been weak from foreign official accounts:

Looking at a longer term view, we see Japan's big currency intervention in early 2004 leading to a surge in treasury holdings. That leveled off into a relatively steady accumulation of treasuries. Then there was a large shift out of treasuries into agencies:

Have we reached another turning point where agencies also go out of favor? I can't fault the strategy of foreign central bankers:

Step 1. Drive your currency down to decimate the American manufacturing base and boost your own productive capacity.

Step 2. Fund the US government's military misadventures to bankrupt the US and cause destruction in other developing parts of the world.

Step 3. Fund the overconsumption of the American consumer, turning them into your debt servants through mortgage backed securities.

Step 4. Use your wealth to command the lion's share of the world's natural resources in times of scarcity.

<< Home