Homebuilders know something is wrong with their industry. They just haven't figured out what it is yet (hint: it's the rebalancing process). Homebuilder confidence has taken the biggest and steepest dive ever, and it isn't anywhere near over yet:

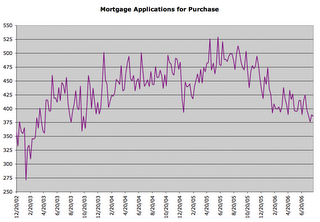

They are still selling a lot of homes, just not as many as they were over the last two years, and not as many as they thought they'd be selling when they made their business plans for the coming years.:

Thanks to an endless supply of misinformation from industry economists, the public has been very slow to realize that housing is heading into another multi-year decline. Ignoring the extreme froth of the past two years, housing demand remains high on a historical scale. It still has a long way to fall from here because American homeowners aren't going to be able to afford as much home over the coming years.

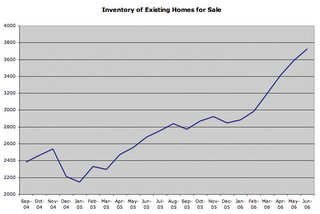

Builders don't understand that the rebalancing process is slowly but surely squeezing people out of being able to afford to buy and live in typical single family homes. Foreign purchases of mortgage backed securities over the past few years provided easy credit for home buyers, but that credit is drying up and many borrowers are realizing they can't make the payments now that living expenses are rising and their ARMs are resetting. The number of existing homes for sale on the market is exploding:

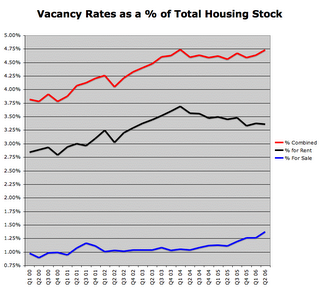

Vacant units are at an all time high, with rental vacancies declining, but still historically high. Meanwhile vacant units for sale keep rising because homebuilders have been building far more homes than the country needed:

Seeing the trend in rising demand for new homes and condos, builders bought up land and made plans to keep building at an accelerating rate on into the next decade. The trend changed direction and caught them off guard. They're cancelling land option contracts, but still have far too many communities and condo towers under development. Many unsold condos will end up as rental units eventually, so the condo boom isn't all that bad a thing, but the single family residences in the outer suburbs are going to be an albatross around the builders necks. Eventually Americans will come to realize that the single family McMansion with a 1 hour commute isn't a cost effective way to live. The rest of the world already has cost effective housing. America will be forced to adopt more of it as the rebalancing process continues.

Orleans Homebuilders is arguably the worst run of all the homebuilders based on their stock performance over the past 5 years and the abysmal failure of most of their acquisitions. Orleans set a new standard for futility in Q2: They reported negative New Orders for a region.

On the conference call they mentioned that they had 99 cancelations and 51 gross sales for net sales of-48.

Another oddity: Total average selling price is higher than average selling price in any one region. That's because Florida's average selling price is the lowest of their regions and subtracted a smallish amount from total net sales. No doubt low-end buyers are feeling the squeeze hardest and first. This, along with the incentives builders are opting for rather than price cuts, is masking the fact that home prices are now declining in most areas. That trend will get much worse as a rising number of foreclosures wreaks havoc on the market.

Dominion and Levitt were the first homebuilders to report losses (in Q1 of this year). Comstock joined them in Q2. Orleans hasn't joined them yet, but they did lower guidance from $3.05ish to $1.88ish for the year ending 6/30/07, this with backlog down from 1406 to 715 year over year. That new estimate is still too high, and I'll be surprised if they don't start showing losses (along with most builders) in the March quarter of 2007.

Q2 was actually still a good quarter for the industry. Sales began falling much more rapidly in July and August, as evidenced by the builder confidence chart. As I keep repeating: This housing slump is only just beginning because the rebalancing process is only just beginning.

<< Home