TIC Trends

June TIC data came out today, showing more of the same themes:

Reduced purchases by official accounts and net sales of US treasuries.

Private foreign accounts picked up the slack, but I suspect those are largely hedge funds doing the buying and borrowing much of the money into existence to do so.

Corporate bonds remain a favorite of foreign investors.

They've been deserting US equities, lately.

The more interesting data is found in the Major Foreign Holders report that the media always seems to ignore. The data is important for the rebalancing process because it gives a clue as to how much money is being invested by foreigners back into treasuries and how much Americans have to print to pay the bills. The data is revised after processing a big survey every June, and current data hasn't been revised yet. The revision recalculates how much of the treasury debt that is sold into major banking centers (like the UK and Switzerland) is being held for investors from other countries. Trends in that data are interesting enough on their own.

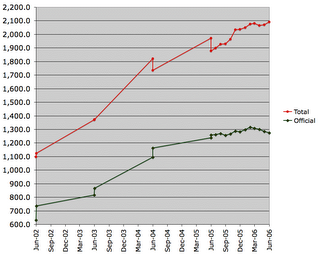

Here are a couple of charts I conjured that includes historical MFH data:

The above chart shows that in the past couple of years much of the money bought into foreign banking centers was actually purchased for US clients. Consequently, major foreign holdings will likely be revised down substantially when the next data series begins next month.

The chart also shows that official accounts clearly began reversing course in March, about the time the dollar took a dive.

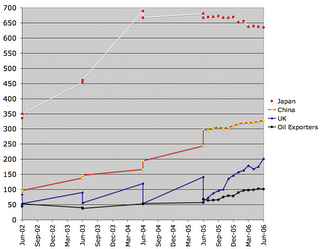

The second chart shows how Japan, China and Oil Exporting countries have been the largest financiers of the Federal Debt. Japan has been reducing holding substantially, and since they appear to have become a financial center, we'll probably see a good downward revision after this year's survey is processed.

China has seen the biggest increases in past surveys, and we'll probably see a huge jump this year based on the rapid growth of UK holdings over the past 12 months (UK holdings always get revised down the most). Oil Exporters and Caribbean banking centers typically get a big boost with the revision, so we'll get a hint about the role of Caribbean hedge funds (relative to UK based hedge funds) in financing the debt with the next revision as well.

Other data I've been watching suggests that China is letting the dollar float a little more freely and slide at a faster rate, so they may be buying even less debt now, leaving hedge funds and oil exporters to pick up the slack. It's an evolving story, and one I'll keep watching.

<< Home