Car Makers and Car Dealers Have a Growing Problem

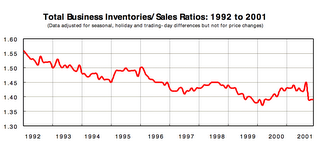

Retail inventories have been in a long-term downtrend as retailers have become more efficient at inventory management. That trend is shown in this chart of inventory to sales ratios from the Census Bureau:

The times when Inventory/Sales ratios are rising typically come in economic slowdowns and recessions, as seen in the 1995 and 2000-2001 periods. If those ratios are picking up now, then it provides further evidence that we are heading into an economic slowdown.

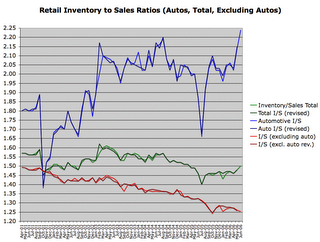

Automotive sales make up about 1/4 of total retail sales in the US. When there is a big uptick in car sales it has the effect of bringing down inventory to sales ratios for the entire retail sector. I created my own chart based on data from the Census Bureau, adding a couple of lines with a calculation of retail I/S excluding automotive sales:

It is interesting to note the way automotive inventories have run counter to the broader trend in retail. Except for a couple of notable downward spikes, automotive inventories have been building and took an especially large jump in May and June to new record highs. Short sighted decisions by auto executives have handcuffed Detroit's big car makers, leaving them on a path toward bankruptcy:

-In order to keep wages down, they've made job security guarantees that prevent them from cutting production in the face of falling demand.

-They've opted to produce mostly high margin, gas guzzling muscle cars and SUVs instead of going after first time buyers with economy models.

-They've made generous promises regarding retirement benefits that have proven impossible in the era of escalating health care costs.

-They've stuffed dealer lots full to the bursting point so that they can report those cars as sales in their quarterly earnings reports.

All this leaves Detroit in a bind where they have to keep producing more cars than they can sell profitably. Periodically they try to promote their way out of the problem. They had great success post 9/11 with a patriotic call to Americans to defeat terror by purcahising gas guzzlers with 0% financing. They also did very well by offering deals on unloved models at employee pricing last summer. While those efforts cleaned inventory out of dealer lots, they also resulted in substantial financial losses. In both cases it didn't take long for inventory levels to bounce back up to new highs after the promotions had ended.

The upswing in overall I/S of the last several months coincides with the onset of global economic rebalancing and shows that the retail sector has begun feeling the pressure of the rebalancing process. It should get much worse before it gets better, as the rebalancing process has a very long way to go.

Here's part of an old post of mine from 12/22/05 going into greater detail on the nature of GM's problems:

The two most spectacular stock meltdowns of this century have so far been Worldcom and Enron. GM has the potential to outdo both of them in terms of total damage. While vast amounts of shareholder wealth were lost as the first two frauds unraveled, GM's eventual default will likely result in far more lost wealth. Worldcom had roughly $30 billion in debt when it went under, but GM has almost 10 times that amount.

Not included in GM's official debt is over $60 billion in unrecognized benefit plan losses. My reading of the last 10-K has GM with a "fully funded" pension plan that has $38 billion in Pre-paid expenses recorded as assets offsetting $36 billion in unrecognized loses. In other words, GM is pretending to have $38 billion in pension plan assets that really don't exist because they haven't gotten around to admitting how much money the pension plan has lost. On the Other Benefits side, they've recognized $28 billion in losses so far, and eventually expect to recognize another $28 billion. The main reason why the pension plan trust is fully funded is that the law requires it. Meanwhile, the laws governing Other Employee Benefit Plans are not as strict and there is a mere $16 billion in assets in the benefits plan trust while GM calculates it would need to have $61 billion in the trust for it to be fully funded.

In both cases accounting laws allow GM to dramatically overstate earnings and book value by postponing the day when the expenses are recognized. With so few assets set aside in the benefits trust, it fell behind by an additional $4 billion in 2004, even after GM added $5 billion in assets to the plan. In my mind this constitutes somewhere around $8 billion in losses that should have been reflected on GM's earnings statements. While not recognizing those losses may have been legal under current accounting standards, the earnings as stated to the public are highly misleading. At the end of 2004, GM had only $27 billion in shareholder equity. Had those pension and benefit plan losses been recognized, GM's shareholder equity would have been less than a negative $30 billion. In the first 9 months of 2005, GM's liability for other benefits increased by $4 billion and they have reported $3.8 billion in net losses as reality began catching up with the company.

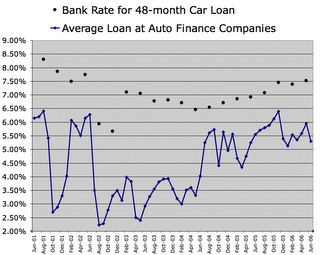

A big lesson learned from Worldcom and Enron is that a fraud can go on as long as creditors are willing to lend cash to the fraudulent enterprise. Once creditors lost faith in those two companies they had to declare bankruptcy. GM is far more dependent on the faith of creditors as its finance division has been their main source of apparent profits in recent years. GM borrows hundreds of billions of dollars and lends it out to its auto customers and to homeowners through its mortgage lending unit (Ditech). With GM's credit rating cut to junk status, the profit margin it can make in its financial unit is reduced. As GM's financial conditions continue to deteriorate, the supply of willing creditors will continue to diminish, and eventually GM will be bankrupt.

Just as GM has much flexibility in the way it chooses to recognize or postpone recognition of benefit plan losses, GM has great flexibility in the way it books earnings from the loans it makes. If it conservatively assumes that many of the loans will end up defaulting and costing the company money, then it will set aside substantial reserves and book smaller profits. If it assumes that good economic times will continue and few loans will default, then it can book much higher profits. Given the way GM has chosen to account for their pensions and the way their backs are pressed to the wall with their creditors, I'm willing to make the assumption that they are similarly overstating earnings in their finance unit through aggressive accounting. If this is so, then we can expect a large number of write-offs as deteriorating economic conditions force GMAC customers into default...

When it all shakes out in the bankruptcy courts, the bag holders will be many. As an S&P 500 and Dow Industrials component, GM is a core holding in almost every retirement plan in the country. Those plans will all face additional losses as a result of the disappearance of GM's imagined wealth. This in turn will eventually impact the bottom line for other companies pension plan operations. GM has over $400 billion in liabilities, including about $250 billion in debt. These liabilities will probably be repaid at some fraction of their stated value, meaning the corporate debt market and its many highly leveraged hedge fund participants will take a highly leveraged blow to the gut. There could be much forced selling as corporate bond positions lose value and wipe out fund equity.

Enron taught us about off-balance sheet debt, and how many risks aren't known to shareholders even if they take the time to read a company's financial statements. In the case of GM, a vast, unknown quantity of off-balance sheet liabilities exist because GM guarantees payments on many of the loans they sell and service. If and when the economy slows and defaults rise, GM has guaranteed the purchasers of hundreds of billions of dollars worth of asset backed securities that GM will make up for missed the missed payments of borrowers. Of course an insolvent GM won't be able to make good on those promises and much imagined wealth will evaporate.

Perhaps the full scope of the situation and the lack of any viable solution has led GM executives, Wall Street, and Washington to turn a blind eye to GM's problem. Perhaps individual greed and systemic neglect has led many to profit off the situation, rather than attempting to fix it. GM's implosion has of course been building in degree for many years, but nobody was willing to take leadership in dealing with it. As a result of avoiding the problem when it could be officially dealt with in good times and a strong economy, GM's crisis must now come unraveling just as the government is facing its own growing debt crisis and as the pension problems in both the public and private sector are coming to a head. Worldcom and Enron finally imploded when (and likely because) the economy was in recession. The fact that GM appears to be imploding when official government numbers are showing solid economic growth is both an indication of the massive underlying problems at GM, and the massive underlying problems within our economy as well.

<< Home