Mainstream Economist Lies

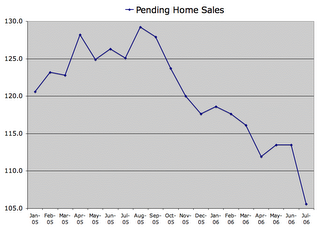

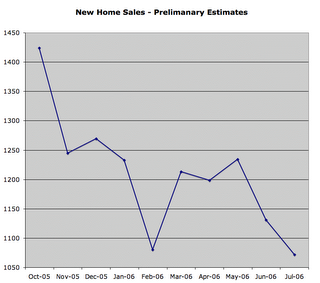

Pending home sales took a steep dive in August, as the housing bubble continued to deflate. It still has a very long way to go, but you wouldn't get that impression from listening to high-ranking housing economists. To them the bubble was a permanently high plateau when we were at the peak and any decline is part of a soft landing.

Pending home sales are one of the most current indicators of the housing market, and they took a steep dive in July:

David Lereah is the chief economist of the National Association of Realtors. His job is to spin the data to the best of his ability so that people want to rush out and buy homes, making money for the membership of his organization. Here's what he's been saying ever since the Pending Sales peaked and turned downward.

September 1st, 2005: “The Pending Home Sales Index is at the fifth highest reading on record, meaning we can expect historically high home sales to continue in the months ahead,” he said. “The index has been fluctuating in a fairly narrow range over the last six months – a very high range – so the overall market is moving forward with a lot of momentum.”

October 5th: “...national sales should stay close to record levels over the next two months and housing will continue to support the economy.”

November 3rd: “We’re still seeing a post-Katrina boost in home sales activity, where the needs of displaced residents are supplementing a fundamentally strong market,”

December 6th: “The drop in pending home sales is an affirmation that we are experiencing a modest slowing in the housing sector,” he said. “The index is pointing to a soft landing for home sales, which will help to correct the inventory shortages that have dominated housing over the last five years. This should restore balance to the market.”

January 5th, 2006: “In other words, home sales have been peaking for the last five years and we will land on a high plateau in 2006 – a market that will be healthy for both buyers and sellers. Investment fundamentals for housing remain solid, preserving generally favorable affordability conditions while offering solid returns as well as a place to live.”

February 1st: “In many recent transactions we’re looking at a delayed effect of mortgage interest rates that peaked in November but are now lower than expected. Mortgage applications have trended up in recent weeks, so we shouldn’t be surprised to see pending home sales rise in the next couple months.”

March 6th: “This looks like we’re touching down for the soft landing we’ve been expecting,”

April 3rd: “We can expect a historically strong housing market moving forward, earmarked by generally balanced conditions across the country and fairly stable levels of home sales with some month-to-month fluctuations,”

May 2nd: “Home sales rebounded from the slide that started last fall, but the pending sales data is showing a dampening effect from rising mortgage interest rates that have been trending up since January,” he said. “This means a modest slowing can be expected in the sales pace in the months ahead, although the market will hold at historically strong levels.”

June 1st: "I see this time of adjustment as being a trough in home sales that will more or less level out toward the end of the year. Over time, homeownership remains the best investment a family can make.”

July 6th: "“The slight change in pending home sales indicates the market is beginning to level out,” Lereah said. “This is consistent with our forecast, which is showing a soft landing for the housing sector. We are entering the second phase of the transition period from the housing boom, in which sellers are becoming more realistic about their expectations – sales are stabilizing and annual home price appreciation is returning to historic norms.”

August 1st: “The housing market is striving for balance – a process that will take several months. A quieting in the movement of indicators should restore confidence to home buyers who’ve been on the sidelines, waiting for the right time to get into the market, and now is the best time we’ve seen since the 1990s in terms of housing choices and flexible terms.”

September 1st: “Psychological factors are causing some buyers to remain on the sidelines, waiting for prices to stabilize or for more favorable news about the market and the economy. Contributing to this hesitancy is a lot of negative news stories, but in the end we believe that underlying market fundamentals will prevail.”

OK, Dave, here's the fundamentals:

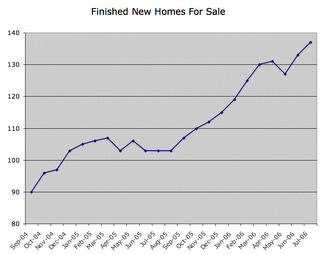

Builders have built way too many houses and they are still building too many because they're stuck with too much land.

Borrowers have overextended themselves and the defaults and foreclosures have only just begun to rise.

The economy is begining to roll over and things will get really ugly when the recession begins.

You know this, Dave but you continue to lie through your teeth to promote a narrow, selfish agenda. Hopefully someday someone will take you to task.

<< Home