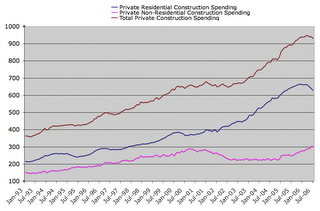

Construction Spending

Construction spending is only about 8% of GDP, and provides only about 6% of non-farm employment. However, it is probably the most vulnerable portion of the economy to recession, and private construction is even more vulnerable than public construction. Many observers are calling for a recession led by housing. I tend to think that excessive debt is causing the economy to stall and a slowdown in housing will increase the severity of the problem. (Because the debt problem is permanent, rather than a function of the credit cycle, I see and economic slowdown as part of the rebalancing process that moves us toward a more sustatinable level of consumption rather than a cyclical recession... now back to the topic of construction spending)

Non-Residential Construction was booming during the late nineties and 2000, as tech companies took their IPO and SPO dollars and built big corporate headquarters. That went into a long, steep slowdown when the bubble burst and the easy money dried up.

Residential Construction has had two brief periods of decline, related to rate hikes and economic slowdowns in 1995 and 2000. It took especially long for housing to roll over this time because rate hikes were met with new waves of lowered lending standards. Excess residential construction the past 3 years will likely give way to several years of slower construction as surplus housing inventory is absorbed.

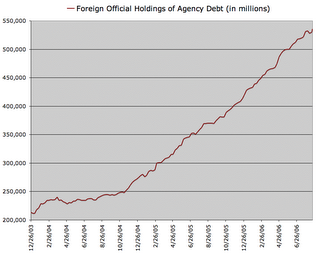

The housing bubble appeared to be deflating on its own at the end of 2004, but then foreign investors started snapping up Agency debt, which helped fund a new round of easy lending and home buying. With housing prices on the decline in most areas, Agency debt has become a poor risk and foreign investors may start to shed holdings the way they've been reducing treasury holdings of late.

<< Home