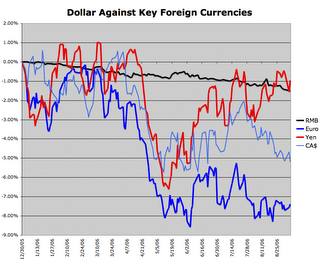

While the dollar has fluctuated widely against the Yen, Euro and Canadian Dollar, the Bank of China has engineered a slow steady decline of the dollar against the RMB.

A couple of years ago, I expected the RMB to repeg pegged to a basket of currencies because that would allow the RMB to stay relatively weak in a global sense, while disconnecting itself from a deteriorating dollar. That was the policy announced last July, but it really hasn't been in effect over the past 14 months. Repegging to a basket may still be the eventual goal, but China appears to have an intermediate stage in mind right now, where the RMB gradually strengthens against the dollar regardless of what the dollar does relative to other countries.

The above chart demonstrates a few interesting points:

1. While the dollar was falling against almost everything in April and May, the RMB actually remained pretty flat relative to the dollar. One would expect the RMB to appreciate more when the dollar was declining against everything else.

2. The Yen has been weakening relative to almost everything since mid-May, presumably because of increased use of the Yen Carry Trade. The Yen declined especially abruptly in August.

3. China and Canada run the greatest trade surpluses with the US and their countries have been strengthening the most relative to the dollar over the past month. (Japan runs a close 3rd to Canada.)

By the end of July, China had accumulated $954.5 billion in foreign reserves, exceeding 2nd place Japan ($864 billion in June), 3rd place Taiwan ($260 billion in July) and 4th place Russia ($259 billion in August). The net wealth of the average Chinese citizen is increasing rapidly (both because of the growth of the foreign reserve pile and because of the rapid infrastructure build that is taking place within the nation) even if most Chinese aren't aware of the long term implications of the country's gains.

Chinese officials talk as though the pile of cash is getting large enough to pose a systemic problem and propose minor changes to try and slow the flow. But in truth I suspect the Chinese government wants to continue amassing wealth as long as foreign governments are willing to let them.

The rate of decline in the dollar/RMB has picked up recently and I suspect the dollar will continue to fall against the RMB because imbalances are so great. Against the Yen, however, the dollar has been very strong of late. Something should eventually give, and as the Yen's weakness is based on trading activities rather than fundamentals I expect a strengthening Yen is the most likely outcome.

<< Home