Here Come the Foreclosures

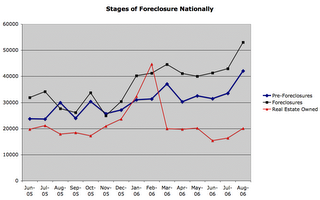

Foreclosures fluctuate seasonally, and they normally trend down through the summer months, which are prime selling months for real estate. This year, however, foreclosures picked up in July and took off in August, when the housing bubble finally burst. I expect foreclosures will accelerate more dramatically from here, as the normal pattern is for increased foreclosures in the Fall and Winter, and the number of distressed borrowers is rising.

The following chart shows one company's tally of homes in various stages of foreclosure nationally:

-Many distressed borrowers now have their homes on the market and will give up on selling their homes as the buying season ends.

-I expect banks will see an especially large surge in defaults in October, November and December, especially in California and Florida where more borrowers are overextended.

-Banks will tend to accumulate more real estate owned during the winter months and try to put it back on the market in Spring, especially in Rust Belt states.

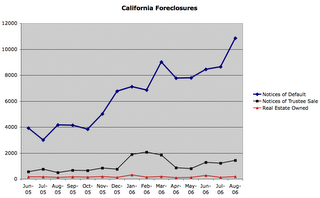

The following chart shows California homes in various stages of foreclosure:

-Affordability issues are killing the market in California and other coastal areas.

-As home price appreciation disappears, cash out refinancing ceases to be an option for most overextended borrowers.

-Notices of Default pick up first, followed quickly by Notices of Trustee Sales.

-Lenders haven't accumulated much real estate because it has been easy to unload homes in foreclosure sales up until now. Some lenders may choose to accumulate real estate and inflate its value on the books, rather than write off losses.

The following chart shows Real Estate Owned by banks in Michigan and Ohio:

-These markets have been relatively soft for a long time, so real estate owned is much higher here than in California.

-Banks have had a cyclal pattern of accumulating real estate in the Winter and selling it off in the Spring.

-These markets are showing the first actual price declines because of forced sales into a saturated market.

Overbuilding led to the rise of surplus inventory. That eventually caused price appreciation to level off. The next big wave has now begun, where distressed borrowers are forced into selling at lower prices. Now we'll start seeing large price declines, as home values decline toward levels that average people can afford. Of course home prices have a long way to fall before they reach those levels, and economic processes take a very long time to unfold. I'm not expecting a bottom in the housing market for at least another 4 years, and probably longer.

Follow-up

Just to share a couple of quick comments I got as a result of posting this item to a board on the Motley Fool...

From a realtor: "Great post, and I agree with one of your key points that this may get much worse in a hurry this winter. The already unfavorable ratio ofsellers/buyers will get much worse."

From a mortgage broker: "Currently banks are simply delaying the proceedings of foreclosure, often times letting the occupants ride free for months and months...

You see... the PUBLISHED REPORTING of the foreclosures could have significant effects on the bank stocks, and the portfolio bond yields... so, we're simply observing the real-world results of yet another slice of unregulated accounting manipulation in the banking industry."

<< Home