Squeezed to the Breaking Point

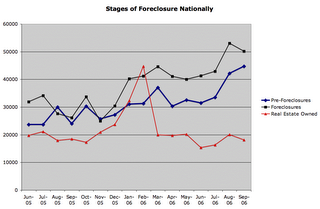

Foreclosures continue to mount in much of the country, according to RealtyTrac. September's national totals were down 0.96% from August, but up 63.5% from the previous September. The 5 States with the highest foreclosure rates in August (with at least 1 foreclosure for every 564 homes) all had significant declines in homes in foreclosure for September, while foreclosures were up 8.5% over August for the rest of the nation.

Anecdotally, many counties are being overwhelmed by the number of foreclosures, causing processing problems, while many lenders are dragging their feet on reporting loan delinquencies as a way of pretending things are OK. It's hard to know exactly how big the mortgage default problem is currently.

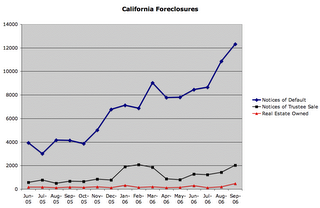

California had the biggest affordability problems and the greatest use of high-risk mortgages. With an an 18.54% rise in September on top of a 24.75% rise in August, it appears these high risk loans have squeezed many to the breaking point and are beginning to take their toll on lenders. Florida and Colorado foreclosures dipped by over 20%, but the rates are still among the nations leaders for the foreclosure process. Connecticut (+556%) and Massachusetts (+373%) saw remarkable monthly spikes.

Here are updates of the three charts I posted last month:

Through all of this, the job market remains strong, even if pay levels and job quality aren't keeping up. Foreclosure rates normally spike during recessions when people can't find jobs, not when plenty of jobs are available. Increased debt service levels and high risk lending appear to be behind the current rise in foreclosure rates. According to the Fed's Houshold Debt Service report, several new records were set for debt service and financial obligations ratios in Q2. Those numbers don't include each houshold's share of Federal Debt service, which has been rapidly rising and now sits at over $400 billion per year.

Keeping the US economy growing now requires a steady infusion of new debt. However, as the debt burden rises, the country as a whole becomes a greater credit risk. Foreclosure numbers are one small indication of what is happening on a grand scale to the US economy. The US government is as bad a credit risk as the typical subprime borrower. It's only a matter of time before the whole debt bubble bursts.

<< Home