Chinese Foreign Exchange Reserves

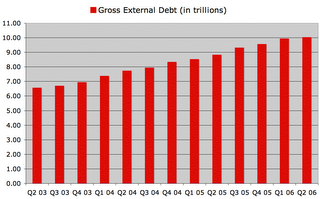

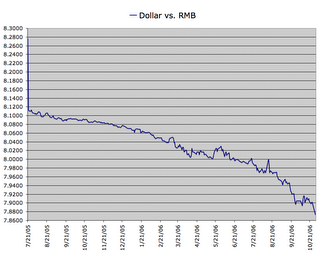

Chinese reserves reached $988 billion by the end of September and are now most likely over $1 trillion. China's wealth continues to increase, and this is leading to a rise in Chinese consumption.

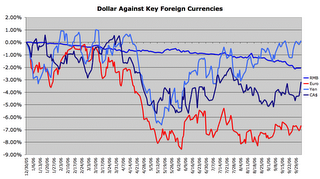

Even more importantly, the skills of its labor force, the quality of its educational institutions, and it's manufacturing base continue to grow in strength, suggesting that China will continue to be a manufacturing power even if it's currency is allowed to appreciate. So the dollar is now falling against the Chinese RMB:

While trade imbalances have been responsible for much of the growth in reserves, there has also been a large amount of foreign investment into the country. The world's largest IPO took place last week, raising around $22 billion for the largest Chinese bank, but that is just part of a long series of Chinese IPOs and foreign ventures into the country.

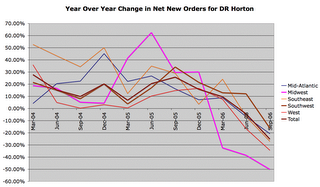

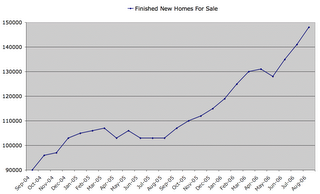

With so much capital already accumulated in the country, it might seem strange for officials to try and attract more. Indeed, Chinese policy makers have been trying to reduce foreign speculation into the country. However, the banking sector in China has made itself vulnerable by extending too much credit to manufacturers and real estate developers. The real estate bubble in parts of China resembles the real estate bubble in the US. (I'm not sure which bubble is worse, Shanghai or Florida).

The big banks have billions of dollars worth of problem loans on their books. To me it seems as though the recent string of bank IPOs are at least in part a way to shore up the balance sheets of Chinese banks on the backs of foreign investors. If so, then it is an improvement over the methods used by the Japanese and American central banks to protect their banks from their own excesses.

In Japan, after the real estate and stock market bubbles collapsed, Japanese banks were technically insolvent. The banks were allowed to stay open while the country instituted a zero-percent interest rate policy to boost banking profitability and eventually bought up stock positions from the banks to preserve their liquidity. After a long period of time, most of the banks had worked themselves out of the hole. Zero-percent interest rates, however, have led to speculative excess in Japan and throughout the world as a result of the Yen carry trade.

In the US, many banks were in trouble after the stock market bubble burst. The Fed lowered interest rates to boost profitability and stimulate the economy, but this dramatically inflated the housing bubble, fueled credit expansion on many fronts and allowed for a dramatic worsening of the trade gap and national debt. The result has been the creation of a much more precarious economic situation.

When the chickens finally come home to roost, and the global economy rebalances, I expect we'll see that the Chinese economy, monetary and banking systems all come out looking the strongest.