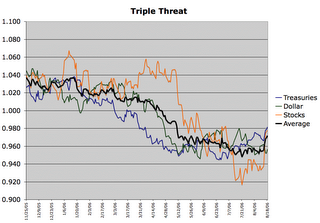

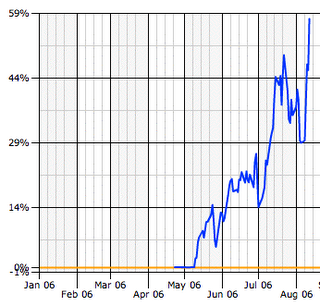

The Sub-Prime Time Bomb Detonated TodayTake a look at today's performance for publicly traded sub-prime lenders:

LEND -17.24% (lowered earnings guidance by about $3 per share)

IMH -11.31% (somebody goofed and filed the 10-Q an hour early)

AIC -10.85% (being acquired by LEND)

NEW -6.22%

NFI -3.82%

DFC -2.03%

ECR -2.44%

SAX +26.16% (being acquired by Morgan Stanley, just in time to save somebody's behind, as earnings stunk as badly as the rest of them)

These upstart lenders fueled the housing bubble by loaning far-more-money-than-they-could-ever-pay-back to people-who-never-should-have-been-buying-homes. It was only a matter of time before defaults got rolling to the point that the sub-prime lenders took a big hit on earnings. Of course it will get much worse from here. The rebalancing process is only just beginning.

From listening to the Accredited Home Lenders conference call it seems clear that LEND and other sub-prme lenders iare getting squeezed on multiple fronts:

1. Competitors from Alt-A have gone from 680+ down to 620 FICO, muscling in on LEND's sweet spot.

2. The secondary market for High LTV, Stated income, and low FICO has dried up. Investors don't want the garbage anymore.

3. In 2005 they relaxed standards and are now seeing more defaults. They've decided to tighten up some.

4. Sales people quit at LEND because they were pushing quality and margins. Salespeople are getting big bonuses at small upstart companies. The execs wouldn't answer the question as to whether the upstarts are private equity funded.

LEND is being forced to repurchase bad loans they had previously sold to investors. If a loan defaults in the first year or so, the investor can make them buy it back. This is also true for loans where there's obvious fraud. It seems that the investors are quick to find reasons to send problem loans back to LEND. These don't show up on losses, but instead get resold at a discount and cut into margins of new sales. LEND thinks this trend will wind down by the end of the year. I think its just beginning.

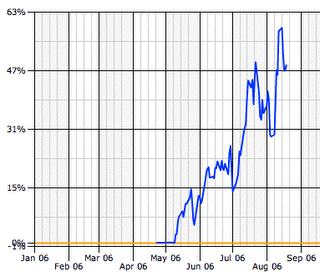

From LEND today: "Delinquent loans (30 or more days past due, including foreclosures and real estate owned) were 3.76% of the serviced portfolio at June 30, 2006, compared to 2.47% at December 31, 2005 and 1.79% at June 30, 2005."

From AIC today:

"Percentage of delinquent loans serviced (period end)"

June 2006: 8.2%

December 2005 5.4%

From SAX today:

($ in thousands) June 30, 2006 March 31, 2006 June 30, 2005

--------------- --------------- ---------------

Principal Principal Principal

balance % balance % balance %

--------- ----- --------- ----- --------- -----

30-59 days past due $370,309 5.53% $273,044 4.20% $307,766 5.04%

60-89 days past due $ 92,635 1.38% $ 82,061 1.26% $ 83,148 1.36%

90 days or more past

due $ 72,494 1.08% $ 58,311 0.90% $ 46,542 0.76%

Bankruptcies (1) $121,559 1.81% $128,280 1.97% $126,391 2.07%

Foreclosures $127,185 1.90% $118,140 1.82% $105,782 1.73%

Real estate owned (2) $ 53,234 0.79% $ 50,039 0.77% $ 41,972 0.69%

Seriously delinquent %

(3) $435,268 6.50% $397,474 6.12% $367,013 6.01%

From IMH today:

"60+ day delinquency of mortgages owned"

June 30, 2006 = 4.16%

December 31, 2005 = 3.12%

June 30, 2005 = 2.01%

The tide has turned for the American consumer, and sub-prime borrowers are feeling it the worst.

Here's something I posted about the Sub-prime lenders on my board on the Motley Fool back on 12/26/05:

Sub-Prime Time Bomb

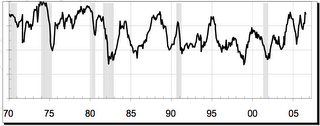

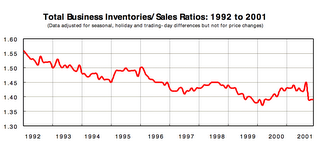

Quick Summary: 2006 and 2007 will be bad years for Sub-Prime lenders because of rising delinquencies, reduced originations and tightening profit margins.The housing market and interest rate environment has been good to lenders over the past decade. From 1993 to 2003 interest rates trended down, while home prices trended up. Charge-off and delinquency rates on real estate loans were low, and even during the 2001-2002 recession, they stayed much lower than the 1991-1992 recession.

The peak delinquency rate on residential loans was 3.36% in 2nd half of 1991, and the low point was 1.42% in Q1 2005.

The peak charge-off rate on residential loans was 0.27% in 2nd half of 1992, and the low point so far has been 0.07% in Q4 2004.

http://www.federalreserve.gov/releases/chargeoff/default.htmWill we cycle back up to high charge-off rates?-No if you believe that the economy is sustainable and doing fine. However, my answer is:

-Yes, if we have an economic slowdown with falling home prices, or

-Not yet, if we have inflation continually driving up home prices and allowing more cash-out refinancing.

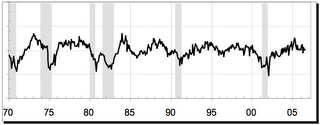

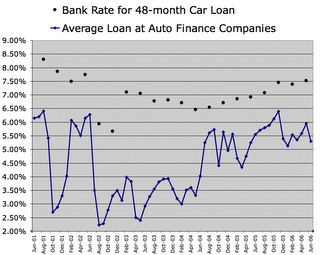

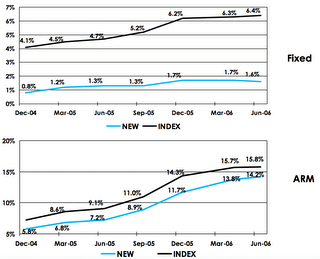

Lately the trend has been toward rising rates and falling profit margins on existing fixed rate loans. We are also seeing more defaults on ARMs and the carry trade would suffer on fixed rate mortgages.

We would probably need to see a big uptick in delinquencies before charge-offs increased substantially, and that may be on tap for 2006.

When hurricane losses finally get recognized (postponed to December, then February) we may see the delinquencies and charge-off rates move noticeably.

There may also be some increased action as the result of the bankruptcy surge in Q4 2005 and the reduced ability for bankruptcy filers to keep their homes under the new law.

From the latest Accredited Home Lenders (LEND) 10-K:

"We focus on borrowers who may not meet conforming underwriting guidelines because of higher loan-to-value ratios, the nature or absence of income documentation, limited credit histories, high levels of consumer debt, or past credit difficulties."This period has been especially good to sub-prime lenders who've done well by taking on higher levels of risk. Their markets have been expanding as homeownership rates rose from a cycle low 63.7% in Q1 1993 to 69.1% in Q1 2005. Sub-prime lenders are generally the ones operating on the margin as the change in the percentage of people who can afford 20% down payments is likely low over time. Indeed, affordability is at an all time low in most regions, so sub-prime lending makes home ownership possible for a large segment of today's market. The growth of the sub-prime market has been extreme because of both the refinancing boom and the housing boom:

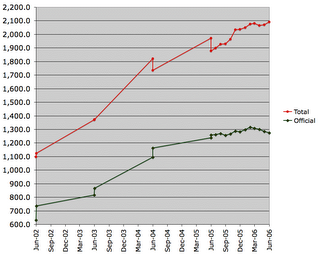

New Century Financial grew from $606 Million in revenues in 2002 to $975 million, to $1.7 Billion in 2004.

Accredited Home Lenders grew from $201 Million in revenues in 2002 to $435 million, to $661 Million in 2004.

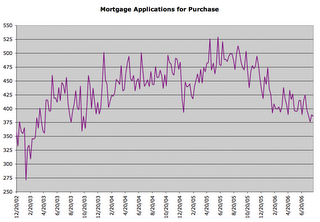

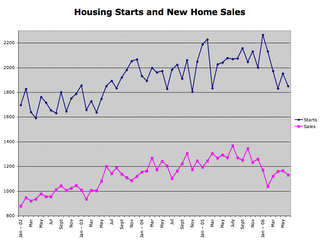

Have we seen a peak in loan demand?Interest rates were higher in 2005, cutting into refinancings, but property values and new home sales rose (until prices edged down late in the year).

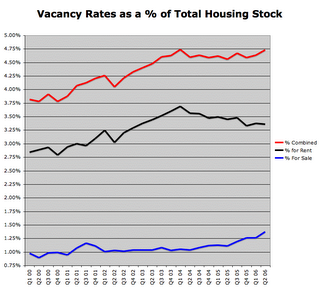

Homeownership rates reached record highs in 2004 and appear to be sliding back down.

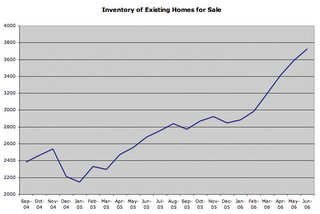

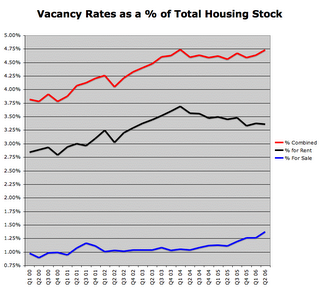

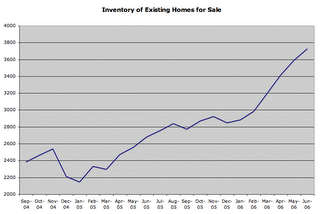

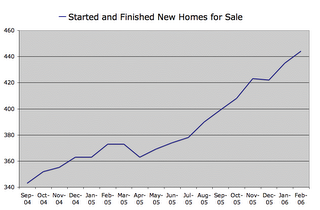

New home sales surged to new highs, but housing vacancies are also at record highs, so housing sales and prices probably won't rise and may soon fall.

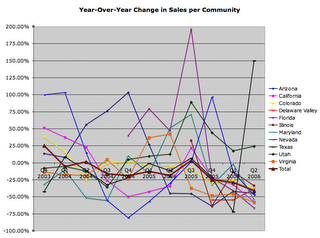

To me the trends appear to be pointing toward a significant decline in demand for mortgage originations going forward. Sub-prime lenders would be affected most because they are the ones operating on the margin.

From the last 10-K for LEND:

50.3% of 2003's loans were 3-year ARMs, 16.2% were 2-year.

20.3% of 2004's loans were 3-year ARMS, 46.9% were 2-year.

Demographically speaking, there is a very large wave of ARMs resetting in 2006 and causing a big payment shock. That wave is not likely to be as big at other lenders as it is at Accredited because of their particular focus on 2s and 3s. I expect a significant rise in delinquencies of 90 days or more during 2006 as a result of this ticking time bomb. Delinquencies are a blow to the cash position as the lender has to keep paying interest on financing and make up the shortfall on securitized financing deals.

Interest-only loans can be ARMS or fixed rate at Accredited and usually become principal paying 25 year loans after 5 years.

0.5% of 2003's loans were interest-only, 14.2% were interest-only in 2004, and a much higher share have likely been interest-only in 2005.

This could make for another wave of payment shock and rising delinquencies in 2009/2010.

From the latest LEND 10-Q:

"the occurrence of a natural disaster that is not covered by standard homeowners' insurance policies, such as an earthquake, hurricane or wildfire, could decrease the value of mortgaged properties. This, in turn, would increase the risk of delinquency, default or foreclosure on mortgage loans in our portfolio and restrict our ability to originate, sell, or securitize mortgage loans, which would significantly harm our business, financial condition and liquidity. While we have not completed our assessment of potential losses stemming from the recent hurricanes in the southeastern United States, we do not expect the resulting losses to have a material adverse impact on our business, financial condition, liquidity or results of operations.That's a little hard to believe given the high number of homes that were destroyed without adequate insurance in the Gulf Coast area this year. Delinquencies may not show up until the June quarter because most lenders and the GSEs keep extending grace periods, but losses on many loans will eventually be much larger than for typical foreclosures where homes were completely destroyed.

Accredited's ability to lend comes from five main sources:

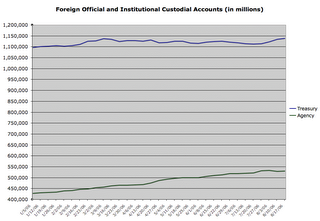

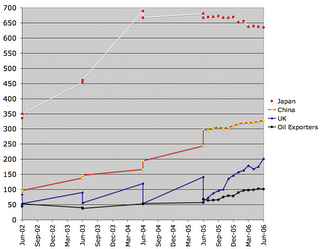

1. Warehouse Lending Facility, with $4 billion in short term loans, mostly from big investment bankers (Goldman Sachs, Morgan Stanley, Merrill Lynch, Credit Suisse, & Lehman).

2. Commercial Paper. $1 Billion in ultra-short term financing.

3. Securitized Financing. They sell securities using loans held for investment as collateral for financing new loans. 1 to 6 year terms on the securities.

4. Whole Loan Sales. Accredited sells most of their loans, pocketing quick profits on originations and funding new loan originations.

5. Preferred REIT Shares. $100 Million paying 9.75%.

LEND has kept their financing terms short to boost profit margins, but this adds greatly to the risk factor. They can hedge the risk of rising rates on fixed rate mortgages, but they can't hedge the risk of rising defaults and real estate losses. If Wall St. watches closely, the big investment banks can cut off financing or demand high rates of return to compensate for rising risk. When and if Wall Street pulls the plug, LEND will be bankrupt in short order.

-Warehouse loans are mostly 1 year deals. Underwriters can choose not to renew or jack up the interest rates based on percieved risk of the underlying securities.

-Commercial Paper is similarly susceptible to perceived risk.

-Securitized Financing fuels the Ponzi scheme, where they overestimate their profits and leverage up based on imagined wealth. If loans underperform, then LEND eats the losses. If delinquencies and losses rise, then the leveraged nature of these bets unwinds their equity fast, and they also have to pay higher yields to holders of existing securities to compensate for the added risk.

-Whole Loan Sales are at market rates. The amount of loans held for sale and delinquencies within that pool are rising. Profit margin was down from 1.86% in first 9 months of 2004 on $5.8 Billion in loan sales to 1.41% in 2005 on $7.9 Billion. They can sell loans at a loss if they need to raise cash, but not if it wipes out too much equity.

-The Prefered REIT Shares give an indication of what LEND would have to pay to borrow money at longer term rates, and it is more than they charge borrowers on most loans. No wonder they need to pursue so much short term financing.

The Sub-Prime risk game is making big profits for company executives, Wall Street banks and major homebuilders. Salaries, bonuses and banking fees are pocketed now.

If defaults rise, then first in line to take losses will be the shareholders.

After the lender's equity is wiped out and they are forced into bankruptcy, then creditors take losses on underperforming loans.

A sudden collapse takes out the Warehouse lenders, while a slow death lets them cancel facilities and force LEND to sell more mortgages.

A continuing rise in the cost of short term borrowing means bigger profits for Wall St., eroding profits for the mortgage bankers and great pain for anyone saddled with an ARM.

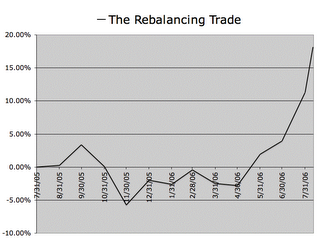

Therefore, I think the most lilkely scenario going forward is:

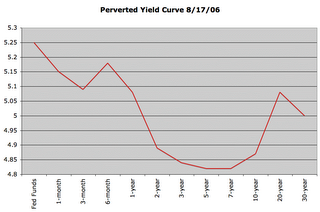

Continually rising short term rates from the Fed, leading to...

Mounting delinquencies from sub-prime borrowers, leading to...

Widening spreads and increased borrowing costs for sub-prime lenders, leading to...

The gradual collapse of sub-prime lenders, leading to...

The cancelation of warehouse facilities (protecting Wall St.), leading to...

Credit contraction in the greater economy, leading to...

The bankruptcy of the sub-prime lenders (bag holders), and

Poor returns for asset backed securities (bag holders), eventually leading to...

Market crash, leading to...

Wall St. using up cash and picking up assets on the cheap, leading to...

Ultra-low rates and steep inflation.