Nouriel Roubini put out

a nice, 8-page .pdf disecting a lot of the nonsense out there describing the trade gap. While I think that he produces almost as much nonsense as he debunks, it's still a good read. Here's my critique, where I address all of his main points:

Interpretation one: many blame the global imbalances on the US’s twin budget and current-account deficits.Roubini rates this as the most plausible explanation, but in my mind it really misses the point. The current-account deficit doesn't

cause the problem. It

is the problem. Meanwhile, the huge federal budget deficit does promote the trade gap because consumers don't factor in their share of the national debt in estimating their own net worth. Roubini's description of swings in savings and foreign investment patterns is basically irrelevant to the problem of why the trade gap exists, although it does help explain some interesting phenomena like the tech bubble, the housing bubble and the bond conundrum.

Two: Ben Bernanke, Alan Greenspan’s successor as chairman of the US Federal Reserve, claims the imbalances have little to do with the US’s fiscal deficit – because the world is Ricardian, that is, consumers and companies offset an increase in government borrowing by saving more, in anticipation of the future tax rises needed to be pay off the extra debt – and are instead caused by a “global savings glut” triggered by developing countries saving too much.Roubini is being very polite in saying Bernanke "overstated" his case. I believe Bernanke (and Greenspan before him) have had the politically motivated goal of shifting blame away from the Fed and US Government for the problem. At best the savings glut concept is an idiotic rationalization and denial of responsibility. At worst (and far more likely in my view) it is a blatant attempt to mislead the investing and voting public. It would not be "responsible" for someone in Roubini's influential position to tell the truth about the Fed.

Three: others argue that the imbalances are largely due to a global investment drought rather than a savings glut.Roubini gives credence to interpretation three, ignoring the obvious other side to the equation: Extreme money supply growth around the world is creating far more investment capital than can be invested at a reasonable rate of return. The problem is especially pronounced in the US, resulting in rapid M3 growth (and thus the discontinuation of the measure) as cash piles up in money market funds. Plentiful investing opportunities would exist if much of the third world was not kept in an impoverished, perpetual state of war and unrest.

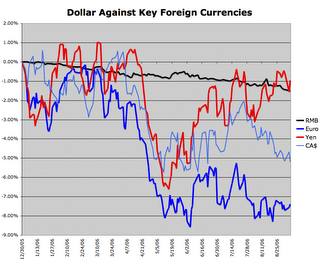

Four: in the Bretton Woods II hypothesis advanced by Michael Dooley, David Folkerts-Landau and Peter Garber, China and other emerging markets are causing the imbalances by keeping their currencies artificially low so as to boost their export-led growth.Roubini says there's some truth in interpretation four, but then makes a logical leap to say that those promoting the view think the imbalances are good. There's a disconnect here, because much of the Economics Underground believes the Bretton Woods II argument while still recognizing that the imbalances are leading toward an economic disaster. In my view, Bretton Woods II has been the biggest cause of the trade gap problem since the early 1980s, because it is the most significant cause of dollar overvaluation. Bretton Woods II only recently has given way to the Yen carry trade in terms of significance in promoting economic imbalance.

Five: the imbalances are caused by China’s excessive saving, owing not to its exchange-rate policy but to the structure of its financial and economic systems. Roubini gives this some credit, but I don't. Reforms I've seen in the pipeline (like allowing Chinese citizens to invest directly in foreign stocks) would tend to exacerbate the problem, rather than solve it like Roubini asserts.

Six: Richard Cooper argues that the imbalances are caused by demographics and low productivity growth – Japan, Europe and China need to save a lot because they are ageing very fast, while low productivity growth in Japan and Europe exacerbates this need.Roubini gives this reason a small amount credit for Japanese and European trade imbalances, but discounts it for China. I can agree with him on that.

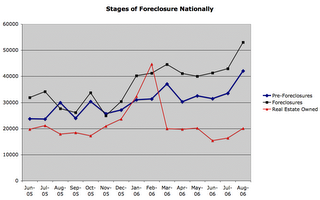

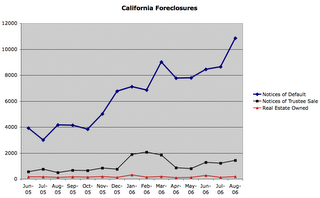

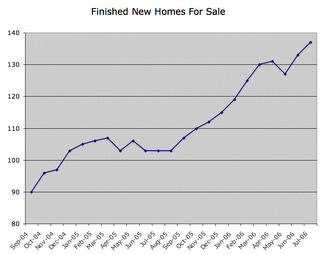

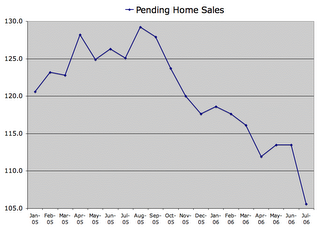

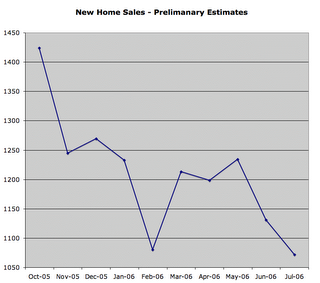

Seven: housing bubbles in the US and a handful of other countries, caused in part by easy money, are responsible for the imbalances, because they have increased investment (in housing) while leading to a consumption boom, and hence reduced saving.Roubini calls these a promising partial explanation, but I think he's mixing up cause and effect. The trade gap boosted the housing bubble, rather than the other way around. Foreigners collected dollars because of currency imbalances and then plowed them into US debt of all kinds, which helped promote the housing bubble. He brings up some interesting connections when he mentions the Yen carry trade and decline of various foreign currencies that were boosted by it, but discounts them as a thing of the past. While there may have been a partial unwinding of the Yen carry trade earlier this year, I believe it has come back in force, and the

rebound of the New Zealand dollar provides further evidence for this idea. The Yen carry trade deserves to be addressed fully in his discussion, but perhaps it is too important and truthful to be given full treatment if this paper is indeed bent on misdirection.

Eight: financial globalisation is the explanation, because as investors are diversifying their portfolios and investing more of their funds abroad, foreigners’ demand for US assets is greatly increasing.I'm with Roubini in discounting this theory, but for different reasons. Roubini tries to argue that foreigners are selling US equities. However, according to TIC data, foreigners are not pulling out of equities. Instead they more than doubled net equity purchases to $116.9 Billion in the 12 months ended June 2006. They've been especially keen on buying US corporate bonds, which tend to be more secure than other types of US assets. For me, again, this theory is another example of confusing cause with effect. The strong dollar forces the accumulation of trade gap dollars which eventually get invested back in the US. Meanwhile, savvy US investors are pulling out of US assets and investing abroad before things really get bad in the US.

Nine: Ricardo Hausmann and Federico Sturzenneger argue that the US current-account deficit is a statistical illusion, because “dark matter” – the intangible value of US-owned foreign assets – is not measured correctly.Roubini is right that this is nonsense, and partially right that US held foreign assets tend to earn more than foreign held US assets. However, he neglects to address the two main reasons for this, which are the long term decline in the value of the dollar and the suppressed yields of US assets due to excessive dollar creation. He also avoids mentioning an important reason why the actual current account deficit is actually much worse than the published numbers, as

described by Raymond Baker in his book

Capitalism's Achilles Heel Specifically, a great amount of money from international organized crime rings and corrupt third world leaders is extracted from poor people and invested into the US without detection in official figures.

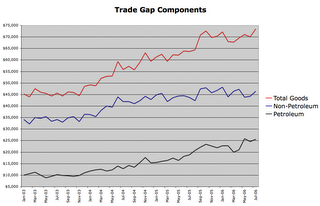

Ten: the oil exporters are to blame, because they are saving rather than spending their huge windfall gains from rising oil prices.Roubini discounts both the size and importance of the trade gap with oil exporting nations. He doesn't seem to realize that the trade gap for petroleum products has been accelerating and is now over $25 Billion per month. Meanwhile, the US consumer is gasping for breath and the trade gap for non-petroleum goods appears to be in decline. Roubini is right to suggest that the US will need to reduce energy usage, but I think he is wrong to suggest that this can or will be done voluntarily or without significant economic damage. The way things are heading, it will eventually require a steep increase in the price of oil due to a sharp decline in the value of the dollar that would force consumers to cut back due to lack of funds.

To sum up my position:

The dollar had been kept low because of Bretton Woods II currency peggin and intervention by the Bank of Japan. More recently, the Yen carry trade has played a greater role. This is the primary cause of the trade gap.

A secondary cause is the illusion of wealth created by over-stimulation from the massive federal deficit and loose monetary policy. Excessive oil consumption is a large and growing part of this.

A third cause is the feedback of investment dollars coming back as the result of the trade gap, although this is decreasing in significance as intervention by foreign central banks has declined.

What to DoRoubini insists that the global imbalances can only be unwound if several countries take action. He wants the US to reduce its budget deficit and increase private savings and I agree that both steps would be beneficial. However, the most important step for the US to take would be to cut short term interest rates and intervene in the currency markets to bring down the value of the dollar. That isn't going to happen because Wall St. is in the insurance business and a stable dollar is essential for protecting the profits of big banks like Goldman Sachs and JP Morgan.

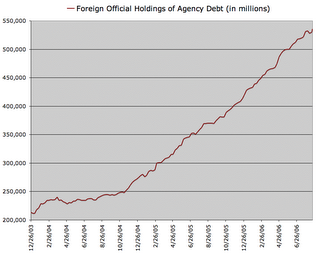

Roubini wants China and other nations to relax their pegs to the dollar and for Europe and Japan to accelerate structural reforms. China has been doing their part in strengthening against the dollar in a very responsible and steady fashion, while the Europe has been grudgingly and whiningly been doing theirs as well. Meanwhile Japan is predictably pursuing its own best interest by keeping the Yen weak. This keeps Japan's economy humming and provides cover for the BoJ to reduce its holdings in US treasuries. As they do this, large amounts of US Treasury and now Agency risk is being transfered to the pension plans of American workers.

Roubini also wants oil exporters to relax their pegs, but this is meaningless because labor in these countries does not compete with labor in the US in any meaningful way. (Excluding Venezuela) wealth from oil exports goes into the hands of the wealthy while the masses receive little benefit. Increasing consumption in these nations would require a substantial redistribution of wealth and power rather than a currency revaluation.

The solutions to reducing the trade gap are amazingly simple. Yet, they go directly contrary to the interests of America's ruling elite. That is the reason the gap has persisted in growing to such dangerous levels. That is also the reason why Economists like Roubini aren't able or willing to tell the true story about global economic imbalances. To do so would be to put their own careers at risk. I am grateful, however, for economists like Nouriel Roubini and Steven Roach who at least are willing to bring attention to these issues. Along the way they provide many interesting statistics and facts that improve the analysis of people who are able to read between the lines.