Trade Gap by Nation(I posted most of this on the Motley Fool message boards 2 months ago, which is why the data is for Q1, and not through May.)

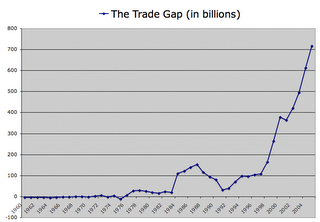

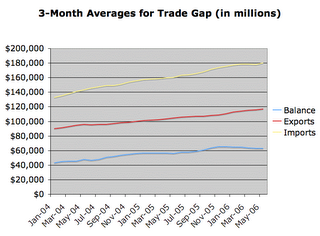

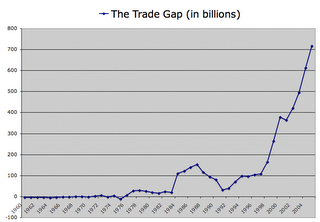

The unadjusted cumulative trade balance for Q1 was -$190,240,800,000, putting us on a pace for around $760 Billion in officially recognized wealth transfer to the rest of the world.

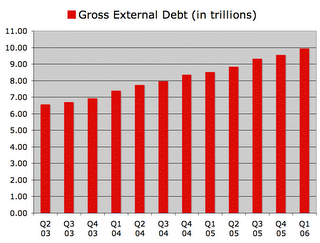

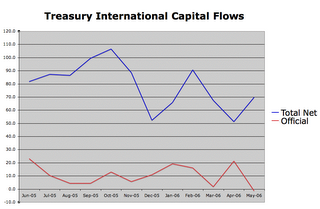

Eventually, the flow of wealth out of the US has to come to slow dramatically (otherwise we'd totally run out of assets and there wouldn't be anything left to sell to foreign investors).

A question I've been exploring for a long time is: What will the reduction in the trade gap will look like?

Taking a look at the US trade balance with individual countries is informative:

Q1 '06 Rank-Country-(Q1 '05 Rank)-Q1 '06 Trade Balance-Characteritic

1 China (1) -$47,321,000,000 Cheap labor and an artificially weak currency

2 Canada (3) -$21,529,000,000 Oil, resources and proximity

3 Japan (2) -$21,147,000,000 Technology and a suppressed currency

4 Mexico (5) -$14,779,000,000 Oil, proximity and cheap labor

5 Germany (4) -$12,101,100,000 Technology

6 Venezuela (6) -$7,296,700,000 Oil and a pegged currency

7 Nigeria (8) -$6,419,000,000 Oil

8 Saudi Arabia (12) -$5,518,200,000 Oil

9 Malaysia (7) -$5,501,500,000 Oil and cheap labor

10 Ireland (11) -$4,801,200,000 Technology and cheap labor

11 Italy (10) -$4,614,200,000 Technology

12 Taiwan (13) -$3,795,000,000 Technology

13 Thailand (15) -$3,466,200,000 Cheap labor

14 South Korea (9) -$3,262,200,000 Technology

15 India (16) -$3,143,500,000 Technology and cheap labor

16 Russia (14) -$2,893,000,000 Oil and Technology

17 France (18) -$2,768,300,000 Technology

18 Sweden (17) -$2,543,600,000 Technology

19 Algeria (24) -$2,541,400,000 Oil

20 Indonesia (21) -$2,459,000,000 Oil, resources and cheap labor

21 Angola (26) -$2,210,600,000 Oil

22 Iraq (23) -$2,018,100,000 Oil

23 Israel (22) -$1,997,500 Technology

24 Brazil (19) $1,939,800,000 Resources

25 Trinidad and Tobago (25) Oil

26 Vietnam (27) Cheap labor

27 United Kingdom (20) Technology

28 Norway (28) Oil and Technology

29 Austria (30) Cheap labor and Technology

30 Equador (29) -$1,089.400,000 Oil

A supply of cheap labor is probably the biggest factor in running a big trade surplus with the US, as long as there is adequate infrastructure and enough trained workers to provide for efficient production. After that comes Oil and other resources, where good infrastructure and domestic tranquility don't seem to matter much. Many technologically advanced nations, including Japan, Germany, Italy, South Korea, Taiwan, France and Sweden run large trade surpluses with the US, probably because the US Dollar has been propped up so high for so long.

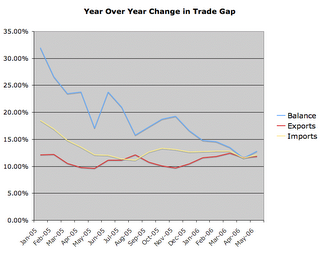

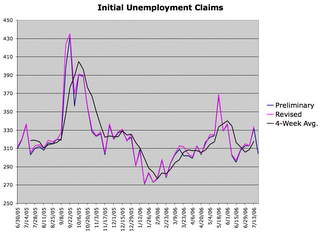

Presumably the huge US trade gap with China could be (and will have to be) reduced by reducing US wages to result in reduced consumption and living standards. Judging by the last two monthly declines in the trade gap, and the ongoing middle-class squeeze, this process has probably already begun. China continues to effectively peg its currency to the dollar. I believe China will eventually have to cut the dollar loose as there has been a speculative bubble forming in Chinese stocks recently.

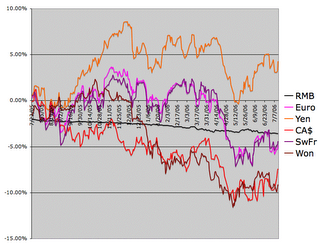

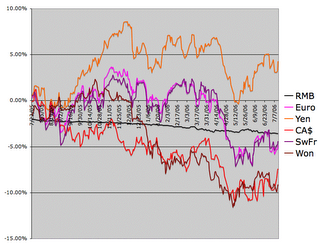

Presumably the trade gap with Japan, Germany and other technologically advanced nations could be corrected with a large decline in the value of the dollar. The Yen and Euro have risen about 7% against the dollar in the last month, and would probably have risen much more if not for the effective peg from China. Europe has been buying up US technology and companies at an alarming rate. The US can't afford to lose its technological edge on the rest of the world if it hopes to reverse the trade gap without a horrible decline in earning capacity and living standards.

Presumably the trade gap with oil exporting nations could be reduced by using much less oil. Energy prices have been rising rapidly, and that may be starting to have an impact on consumption habits, especially in terms of home heating. Oil prices have a lot further upwards to go, at least in dollar terms. Alternate and renewable energy sources will become more practical and those will help on the supply side, while a continuing squeeze of consumers and an economic slowdown will likely result in a decline on the demand side.

The total Q1 trade gap grew from $166 Billion in 2005 to $190 Billion in 2006. It is interesting to note which countries lost ground relative to each other: Japan, Germany, Malaysia, Italy, South Korea, Russia, Sweden, Israel, Brazil, United Kingdom & Equador all lowered their ranking. Meanwhile, those gaining ground included: Canada, Mexico, Nigeria, Saudi Arabia, Algeria, & Indonesia. Rising Oil prices were obviously a very big part of that. In absolute terms, China's trade surplus with the US increased by $5.3 Billion, while South Korea's declined by $1.1 Billion. The Won has been strengthening longer than the Euro has, and much longer than the Yen has, so I suspect the change in currency valuations is already having a significant impact on South Korean exports.

There are a few countries that actually run significant trade deficits with the US:

226 Netherlands +$3,275,800,000

225 United Arab Emirates +$2,872,800,000

224 Australia +$2,369,200,000

223 Hong Kong +$2,047,100,000

222 Singapore+ $1,305,100,000

221 Belgium +$1,095,700,000

220 Panama +$517,700,000

The U.A.E. exports most of its oil to Japan, South Korea, India & Thailand, rather than the US). The others tend to prosperous, centers of trade, rather than exporters. Perhaps the best way to reduce the trade gap is really to increase the prosperity of all nations, so that they can import more from the US. This, however, would require a complete reversal of US foreign policy, which has been to promote violence, destruction and poverty throughout the world in order to claim a greater percentage of the world's resources.

Economic balances are shifting towards a point where the US will no longer be able to plunder the resources of impoverished nations. The transition period will probably be very painful for most Americans. Hopefully this will give rise to a new political way of thinking, where renewable energy, recycled resources and global economic prosperity become the focus for American industry and political leadership.

Trade DataCurrency Data

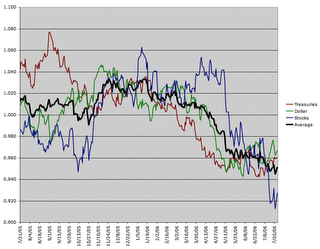

In 1976 the US came out of a recession to run a trade deficit and has run a trade deficit every year since then. That trade gap has grown substantially over time, resulting in tremendous global economic imbalances. I believe those imbalances will reverse themselves and that the rebalancing process has already begun.

In 1976 the US came out of a recession to run a trade deficit and has run a trade deficit every year since then. That trade gap has grown substantially over time, resulting in tremendous global economic imbalances. I believe those imbalances will reverse themselves and that the rebalancing process has already begun.

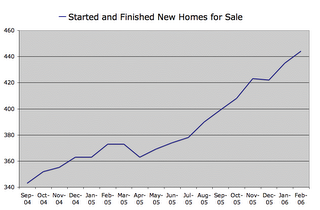

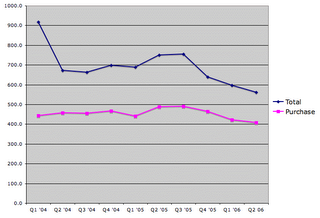

Because so much easy money was flowing into the housing sector, and because they are incredibly greedy, homebuilders went on a land acquisition and building binge that has been producing about 500,000 more new homes than the country has needed per year. Inventory is the biggest problem in the housing market, and we haven't come close to the inventory peak yet:

Because so much easy money was flowing into the housing sector, and because they are incredibly greedy, homebuilders went on a land acquisition and building binge that has been producing about 500,000 more new homes than the country has needed per year. Inventory is the biggest problem in the housing market, and we haven't come close to the inventory peak yet: